Invest in the

Collective Liquidity Fund

Systematic access to late-stage venture

The Collective Liquidity Fund provides investors with access to a diversified portfolio targeting the best late-stage, venture-backed private growth companies backed by the best VCs. Employing a systematic investment strategy, the Fund seeks to track the performance of the “unicorn” asset category while providing investors with unmatched transparency and liquidity.

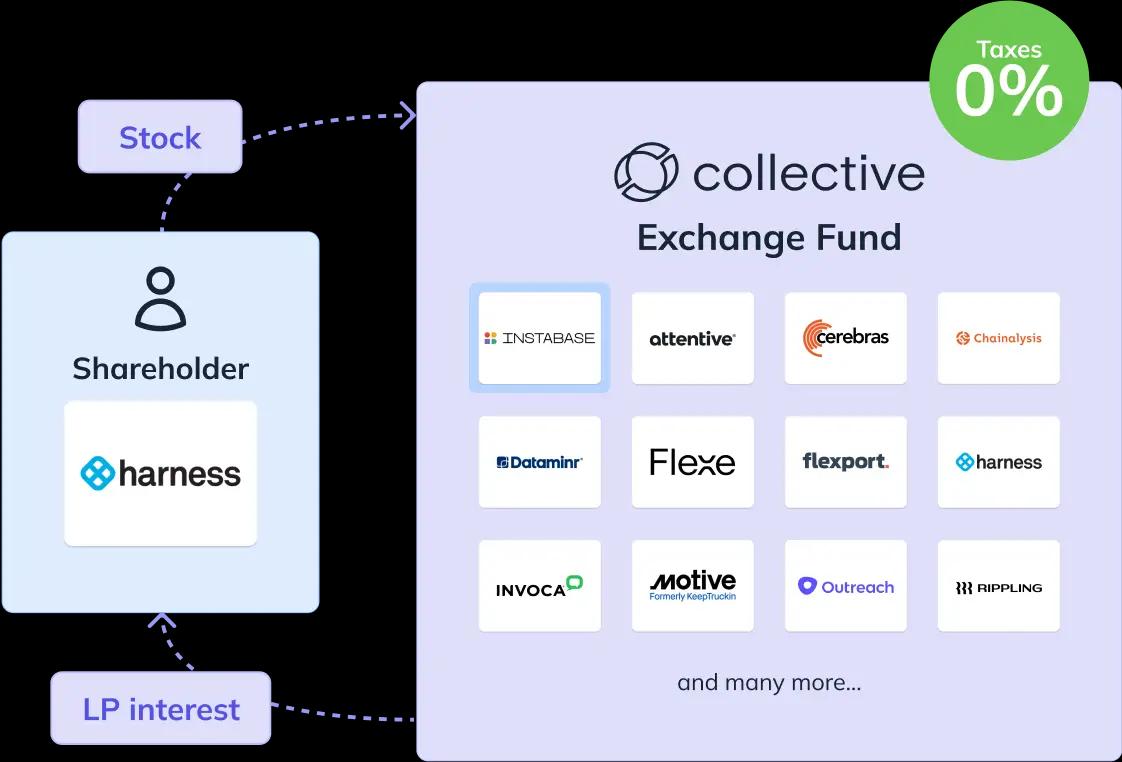

Companies in the Exchange Fund - see also other companies eligible for exchange

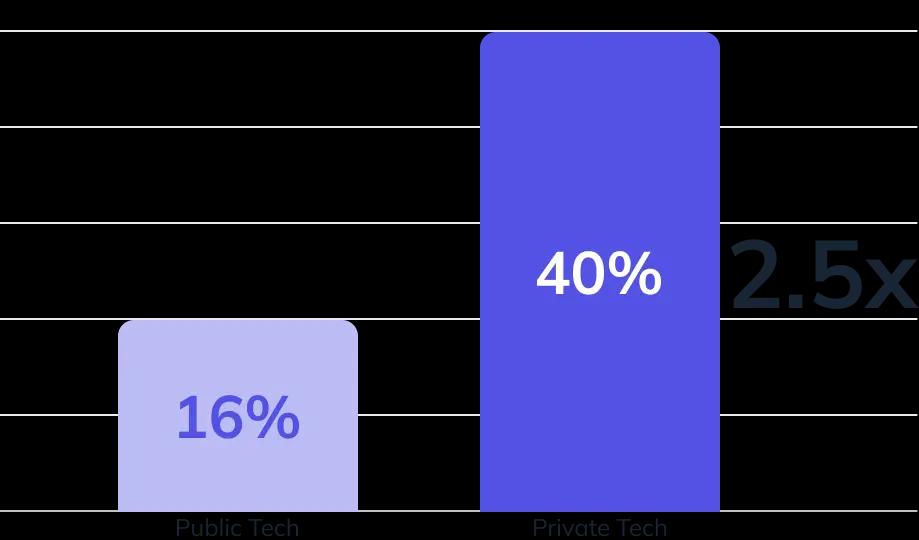

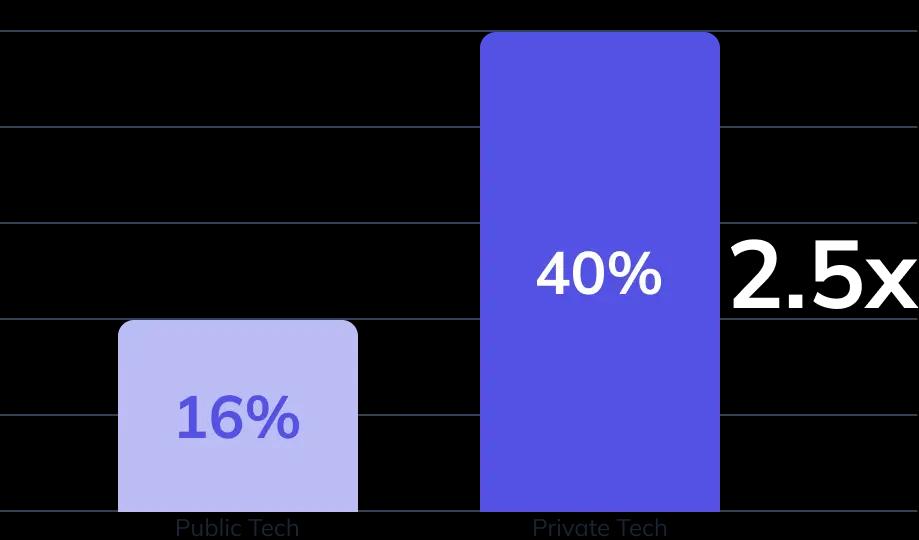

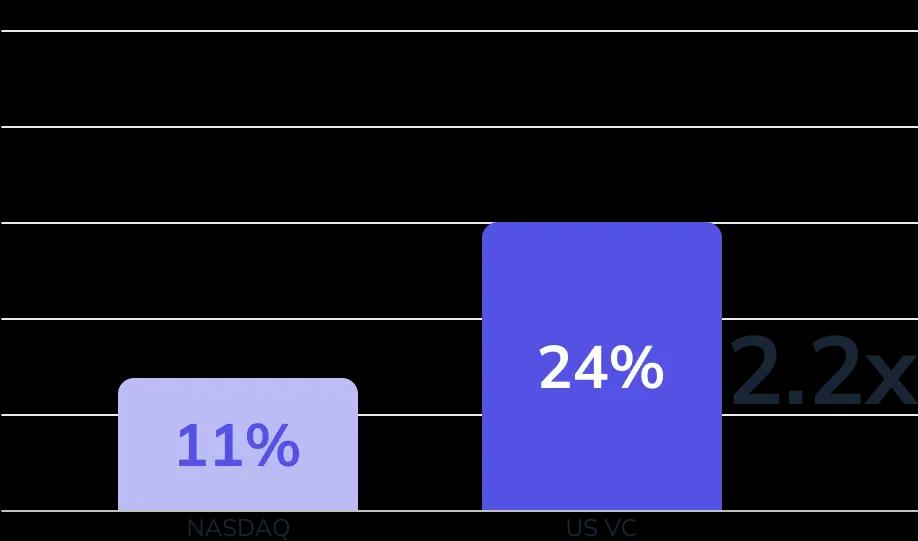

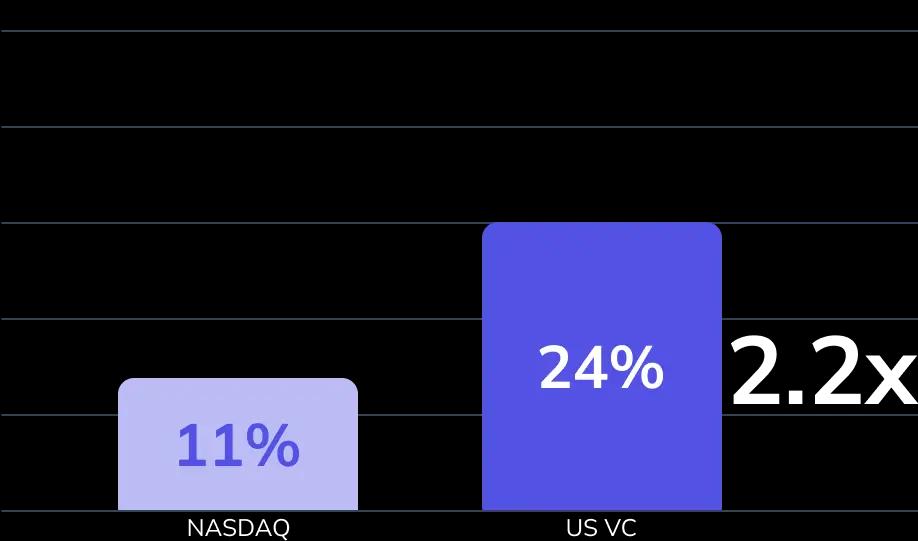

Late-stage venture is a substantial and profitable asset class

Venture is where the growth is, and had outperformed public equities over the long term

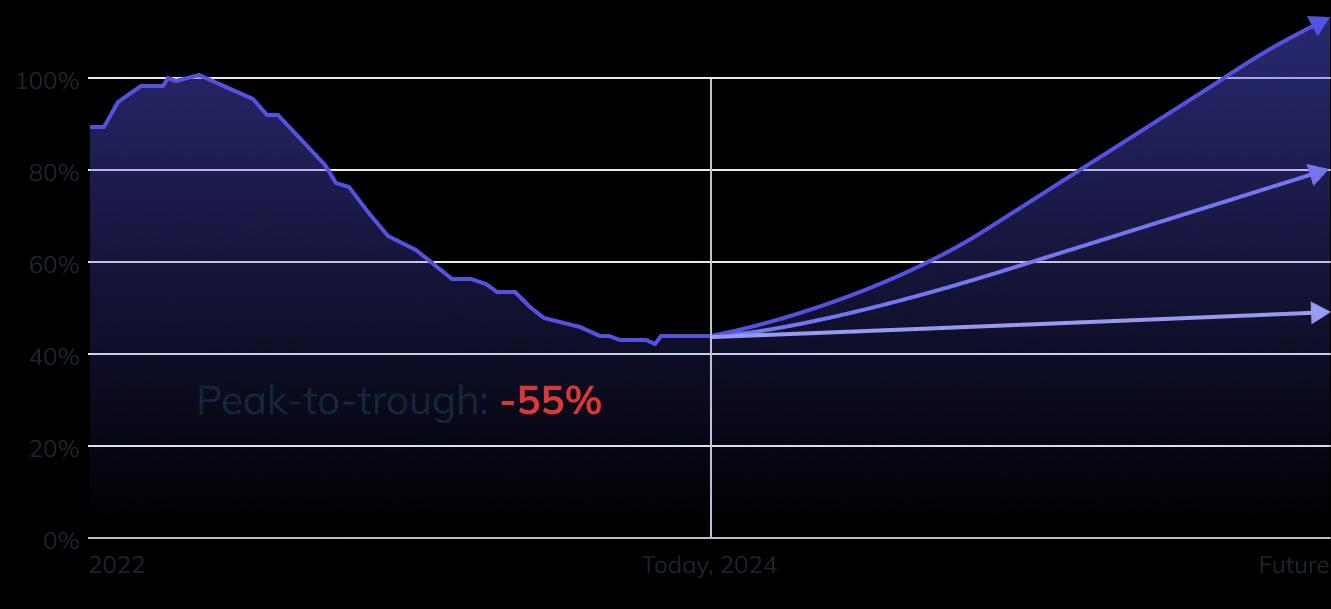

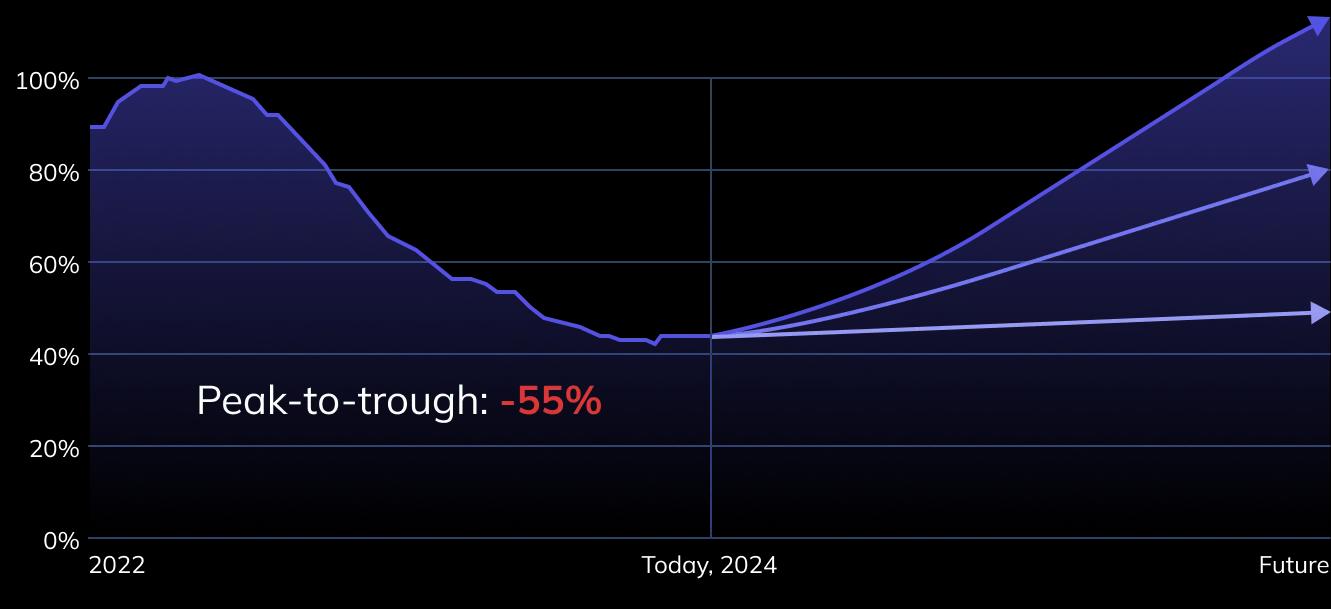

The optimal moment to invest in venture capital is now

nowGoldman Sachs raises $15B secondaries fund. Founder's Fund is calling capital for the first time in years

The Collective Liquidity Fund provides unique access to leading unicorns

| Category | Traditional VC | |

|---|---|---|

| Liquidity | Quarterly redemptions | 10-14 year hold |

| Shares Acquired at a Discount | 44% average discount to latest round | No discount |

| Winners Only | Curated portfolio of top performers1 | Most companies fail3 |

| Co-Investment as a Service | LPs self-select co-investments2 | Occasional access |

| Total Transparency | Daily NAV pricing | GP discretion |

1 Portfolio companies targeted are the strongest companies from leading VCs across all of their vintages. 2 Through Collective Liquidity's proprietary platform, LPs designate portfolio companies for co-investment. 3 In the typical VC model, the performance of each vintage's 1-2 winners is diluted by 8-12 losers.

Request more informationTargeting the Strongest Companies of the Leading VCs

Collective invests in the winners from across vintages of these and other leading venture capital firms:

Fund Overview

Name

Collective Liquidity Fund

Manager

Collective Asset Management

Fund Purpose

To provide institutional, family office and high net worth investors with efficient, liquid exposure to the unicorn asset category

Investment Objective

Principally to provide long-term exposure to the equity securities of late-stage, venture-backed, private growth companies

Investment Strategy

Systematic investment approach to construction of a diversified basket of unicorn equities acquired through in-kind contributions and cash purchases

Target Returns

Representative of the late-stage, private growth asset category

Reporting

Gross NAV published daily, net NAV published monthly

Liquidity

Quarterly redemptions for cash subject to gate and holding periods

Eligible Investors

Qualified Purchasers

Legal Structure

Limited partnership, perpetual, private 3(c)(7) fund

Fund Administrator

SS&C

CohnReznick

Questions?

Your Collective Customer Service Representative is here to answer questions about the fund

Investment Strategy

Passive Approach

The Collective Liquidity Fund combines a passive approach to portfolio management with a unique method of sourcing shares in the most promising private growth companies. Rather than the “classic” venture capital approach of attempting to outperform the market with a relatively small number of investments, the Fund seeks to generally represent the returns of the late-stage, private growth asset category by aggregating shares of over 100 leading unicorns on a rolling basis through Collective's online platform.

Unique Acquisition Pipeline

The Collective Liquidity Fund acquires these shares primarily by having the employees and shareholders of the targeted companies exchange their shares for partnership interests in exchange funds affiliated with the Collective Liquidity Fund. Because such exchanges do no trigger capital gains taxes under U.S. tax laws, the employees are able to diversify much more cost effectively than they could by selling their shares and purchasing diversifying assets with the after-tax proceeds. If the exchanger needs liquidity, they are able to borrow via a non-recourse loan secured by their partnership interests. Many unicorn employees can generate substantially more after-tax liquidity from such loans than they can from stock sales. As a result, where other secondary funds must compete for deals one-by-one, the Fund benefits from a unique, scalable, fully digitized pipeline of the most desirable shares.

Experienced Team

The Collective Liquidity Fund is comprised of the Collective Investment Committee. The Committee is comprised of experienced venture capitalists and fund managers. The Committee is responsible for selecting companies for the Fund’s portfolio and overseeing the Collective Private Market Valuation Algorithm which dynamically prices portfolio company shares.

Request more informationPortfolio Company Selection

Only shares of companies in the Collective Liquidity Fund’s Eligible Companies can be exchanged into the Fund. Companies are selected for the Target Portfolio by the Collective Investment Committee ("IC"). Comprised of experienced, accomplished venture capitalists, the IC first screens U.S. private growth companies valued at over $1B by a number of objective criteria including the backing of certain recognized venture capital firms. The IC then reviews the remaining companies, selecting those that have the best risk adjusted opportunities for long term value creation. Collective's Eligible Companies are updated continuously and always viewable on the Portfolio page of the Collective website.

Request more information"

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price

Warren Buffet, Investor / Entrepreneur / Philanthropist

Jeff Nazzaro, Chief Capital Officer

Interested in learning more about the Collective Liquidity Fund?

Please leave your contact information and a fund representative will contact you

Disclosures

This information relating to the Collective Liquidity Fund, LP (the “Fund”) has been prepared solely for informational purposes, is not complete, and does not contain certain material information about the Fund, including important disclosures and risk factors associated with an investment in the Fund, and is subject to change without notice. It does not constitute an offer to buy or sell an interest in the Fund, nor shall there be any sale of a security in any jurisdiction where such solicitation or sale would be unlawful.

The Fund’s limited partnership interest will not be registered with the U.S. Securities Exchange Commission or other regulatory authority. Investors will be required to verify their status as an “Accredited Investor” pursuant to Rule 501 of Regulation D to participate in any offering of the Fund’s limited partnership interests. No securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through Collective Liquidity, Inc. or Collective Asset Management, LLC (collectively, “Collective Liquidity”).

Limited partnership interests in the Fund are not insured by the FDIC and are not deposits or other obligations of Collective Liquidity and are not guaranteed by Collective Liquidity. Limited partnership interests in the Fund are subject to investment risks, including possible loss of the principal invested.

Prospective investors should consider the investment objectives, risks, fees and expenses of the Fund carefully before investing in the Fund. This and other important information are contained in the Fund’s Confidential Private Placement Memorandum (“PPM”), which can be obtained by contacting Collective Liquidity.

Investment in the Fund involves substantial risk and any offering may only be made pursuant to the relevant PPM and the relevant subscription application, all of which must be read in their entirety. No offer to purchase securities will be made or accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. The Fund has no history of public trading and investors should not expect to sell limited partnership interests in the Fund. No secondary market exists for the Fund’s limited partnership interests, and none is expected to develop. The Exchange Fund has a limited operating history, and its performance is highly dependent upon the expertise and abilities of its manager. There is no assurance that the Exchange Fund’s investment objectives will be achieved, and results may vary substantially over time. This is not a complete enumeration of the Fund’s risks. Please read the Fund’s PPM for other risk factors related to the Fund. Although the manager of the Exchange Fund will value its portfolio using the Private Market Valuation Algorithm, it can be difficult to obtain financial and other information with respect to private companies, and even where the manager is able to obtain such information, there can be no assurance that it is complete or accurate. Because such valuations are inherently uncertain and may be based on estimates, the manager’s determinations of fair market value may differ materially from the values that would be assessed if a readily available market for these securities existed.

The information contained herein does not constitute a recommendation or advice by Collective Liquidity. You should consult your own tax, legal, accounting, financial or other advisers about the information discussed herein based on your specific risk profile and financial situation, including the suitability of an investment in the Fund, with Collective Liquidity, or any product managed by Collective Liquidity.

The information contained herein is for informational purposes only. This material contains the current opinions of Collective Liquidity and such opinions are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

* © 2023 Forge Data LLC ( “Forge Data” ). All rights reserved. The Forge Private Market Index is calculated and disseminated by Forge Data and is a mark of Forge Data. The Forge Private Market Index is solely for informational purposes and is based upon information from sources believed to be reliable. It is not possible to invest in the Forge Private Market Index, and Forge Data makes no assurance that any investment products based on or underlying the Forge Private Market Index will accurately track index performance or provide positive investment returns. Forge Data is not an investment adviser and makes no representation regarding the advisability of investing in any asset classes or investment vehicles. Private company securities are highly illiquid, and the Forge Private Market Index may rely on a very limited number of trade and/or IOI inputs in its calculation. Brokerage products and services are offered by Forge Securities LLC, a registered broker- dealer and member FINRA /SIPC.