The Collective Exchange Fund: Tax-Deferred Diversification for Unicorn Shareholders

How Collective Liquidity enables unicorn shareholders to diversify out of over-concentrated positions on a tax deferred basis

"Diversification is the only free lunch in finance."

(Harry Markowitz, Nobel Prize-winning economist)

Over the past decade, many employees of private growth companies have seen their company stock options increase enormously in value. When it comes to making a smart financial plan for their newfound wealth though, they find themselves in something of a predicament. They understand the risks of having so much of their net worth tied up in one company but don’t see an obvious alternative. During periods of great volatility in venture capital markets, the risk to their net worth (and their related anxiety level) is significantly increased.

The obvious answer, of course, would be to sell their stock and use the proceeds to purchase a diversified portfolio, reducing their financial risk. However, because their shares have seen such significant appreciation, capital gains taxes and brokerage commissions could potentially eat up more than half of their sale proceeds.

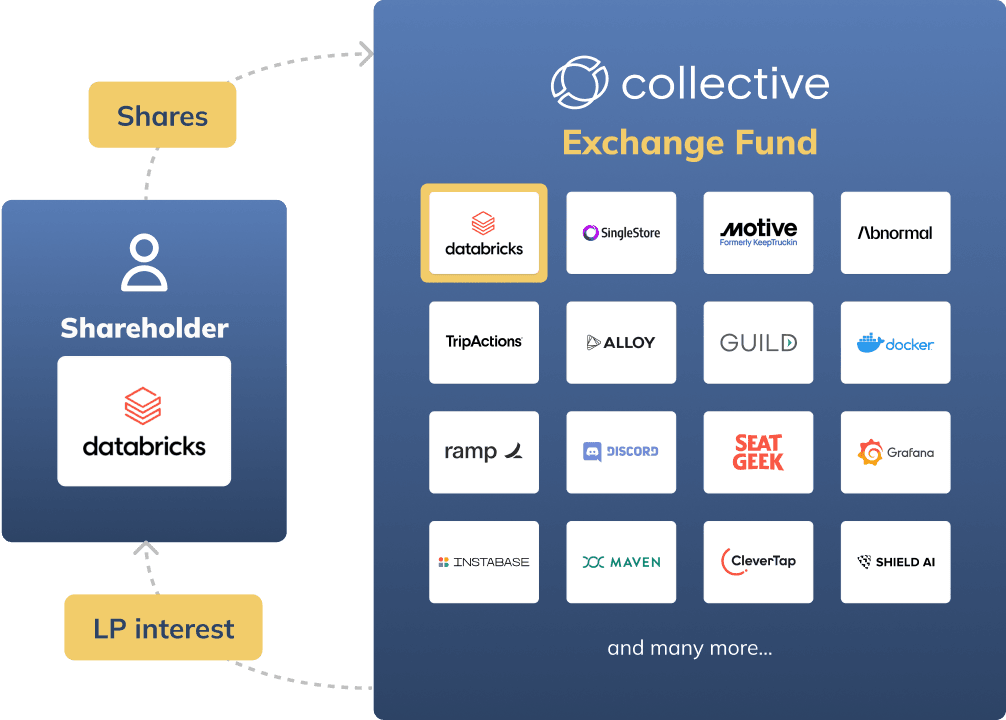

The Collective Exchange Fund was designed to address this problem. Shareholders of eligible companies can exchange their stock for an interest of equal value in a diversified portfolio of “unicorns” without triggering a capital gains tax or brokerage commissions.

Collective Exchange Fund Highlights

- The Collective Exchange Fund (the "Fund") portfolio is comprised primarily of late-stage, private growth companies listed on the Collective Liquidity website

- Shareholders and option holders in these companies may exchange their shares for a limited partnership interest in the Fund of equal value on a tax deferred basis

- Fund Limited Partners seeking liquidity may generally borrow against their partnership interest on a non-recourse basis

- Fund limited partners may elect to redeem some or all of their Fund interest for cash at the end of each quarter, subject to certain important limitations

- To qualify its limited partners for certain beneficial tax treatment, the Fund also holds roughly 20% of its assets in real estate

The Fund's Investment Manager

The Collective Exchange Fund is managed by Collective Asset Management, LLC (the "Investment Manager"). The Investment Manager is overseen by highly experienced venture investors and fund managers and is responsible for selecting companies for inclusion in the Fund's portfolio, valuing their securities and ensuring that diversification targets are addressed. The Investment Manager leverages proprietary technology of Collective Liquidity, principally its Private Market Pricing and Allocation Algorithm, to assist them with these responsibilities.

The Collective Exchange Fund

The Collective Exchange Fund is a pooled investment vehicle enabling shareholders in selected private growth companies ("unicorns") to contribute their shares into the Fund without realizing capital gains tax. In return, they receive a limited partnership interest in the Fund of equal value. So, for every $100,000 worth of unicorn shares contributed into the Fund, the shareholder receives a $100,000 limited partnership in the Fund.

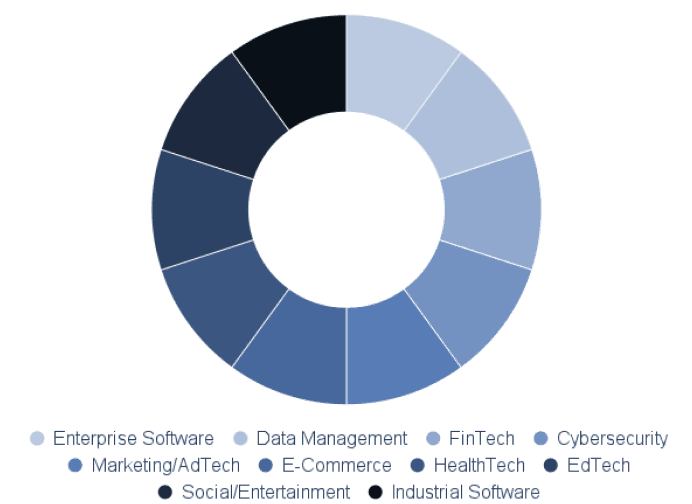

The Fund seeks to maintain a portfolio of unicorn securities diversified across various technology sectors and to maintain limits on the size of any individual position in the portfolio. The Fund also holds approximately 20% of its assets in real estate in order to preserve the tax deferred nature of contributions into the Fund.

From among the universe of late-stage, private growth companies, the Investment Manager strives to select those with best risk adjusted prospects for appreciation and an exit within the next 2-3 years. Shares are generally valued at the time of their contribution into the Fund by the application of Collective's proprietary Private Market Valuation and Allocation algorithm. The algorithm aggregates and integrates many private market price signals and data points to determine a single enterprise value for each portfolio company.

Benefits of the Collective Exchange Fund

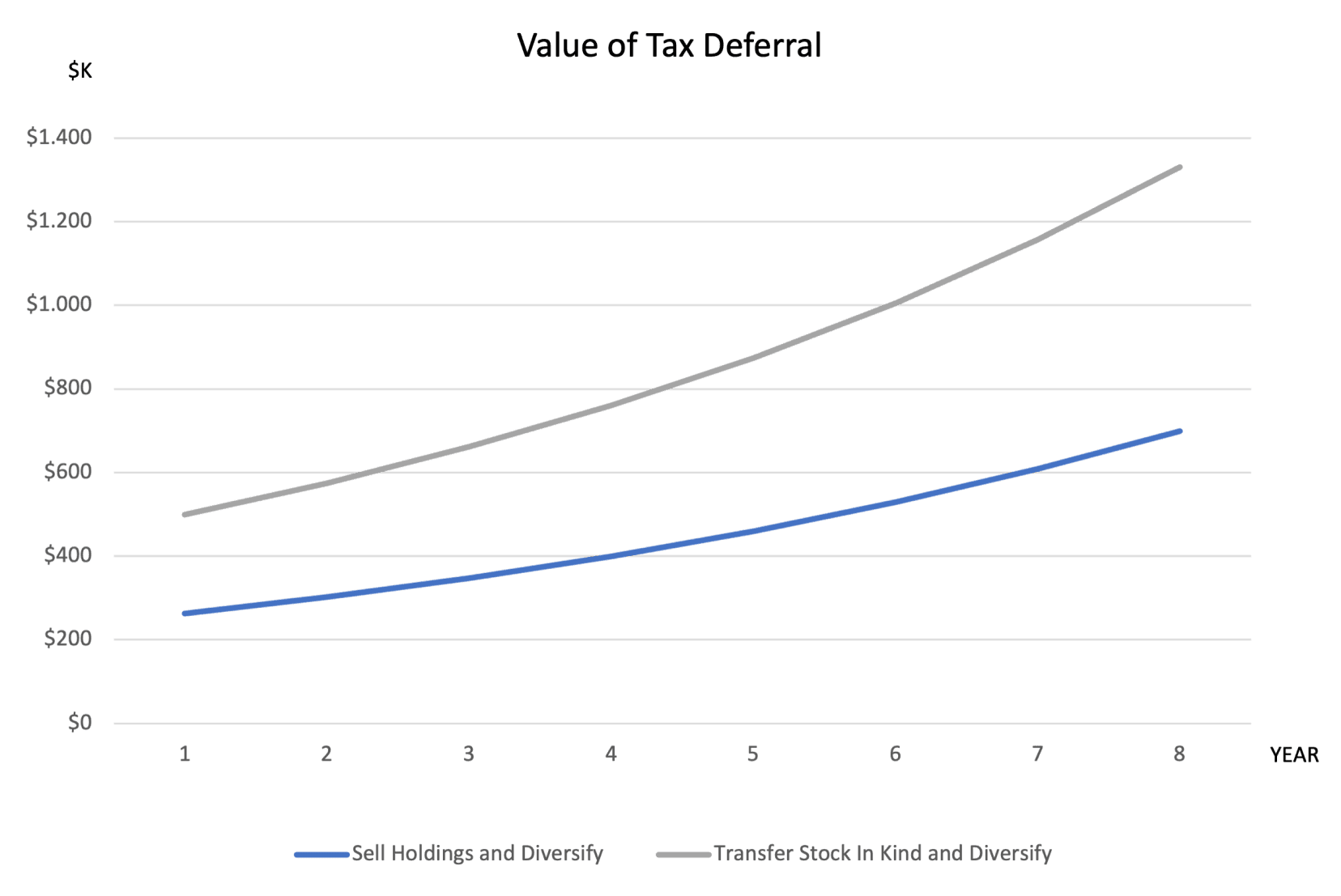

There are potentially significant advantages to obtaining diversification by exchanging into the Fund versus selling shares and using the proceeds to purchase diversified securities. In the latter case, the shareholder generally must pay state and federal capital gains taxes and brokerage fees amounting to as much as roughly half their sale proceeds. As a result, for every dollar of assets they sell, they can only purchase $0.50 worth of a diversified portfolio of securities. With an exchange fund, however, the shareholder receives a $1 worth of a diversified portfolio for every $1 worth of their shares. Over time, the difference in financial outcomes between the two approaches can be dramatic as shown in the example below.

This hypothetical illustration shows a $630,000 (90%) difference in value over time between (a) selling shares and investing the after-tax proceeds in a diversified portfolio vs. (b) exchanging on a tax deferred basis into a diversified portfolio. It makes the following assumptions:

- the stock has been held less than a year by a California resident and has a current value of $500,000 with a tax basis of $50,000;

- applicable federal tax rate is 35%; state tax rate is 11%; brokerage fee on stock sale is 6%; and

- the return on both the proceeds from the “Sell Holdings and Diversify” and the exchange approaches is 15% annually net of management and/or performance fees.

*Please see additional important disclosures regarding this chart at the end of the article.

Risks of the Collective Exchange Fund

Investments in private growth companies are inherently risky and there are also potential risks specific to exchange funds. Some of these risks include:

- Performance is not guaranteed. It is possible that the position(s) a shareholder contributed to the Fund will outperform the Fund's portfolio. The Fund may also fail to match the performance of the overall late-stage, private growth asset category.

- Liquidity may be restricted. Though the Fund offers quarterly redemptions to its limited partners beginning on the first anniversary of their contribution, such redemptions are subject to restrictions in some circumstances. These restrictions are described in detail in the Fund's Private Placement Memorandum and other subscription documents.

- Tax laws are subject to change. Although any change to the favorable treatment exchange funds receive would most likely be grandfathered in for current investors, it is possible that taxing authorities could elect to make such changes retroactive.

- Fees can impact returns. The Exchange Fund charges annual management and performance fees, which can have a material impact on performance.

- Real estate assets are included in the fund. Exchange funds generally need to invest at least 20% of fund assets in certain non-security investments—usually satisfied by purchasing real estate. These assets may adversely impact performance, increase risk and expose the fund to interest rate movements.

For a more complete description of these risks and a description of other risks related to an investment in the Exchange Fund, please review the Fund's Private Placement Memorandum, available for download from the Collective Liquidity website.

Learn More

The Collective Exchange Fund can offer valuable benefits to many shareholder of private growth companies. To find out if the Exchange Fund is right for you, please visit us at www.CollectiveLiquidity.com or call us at 1-888-977-5228. Our Customer Service Representatives are standing by to answer your questions.