Good for your employees,

great for your company

Collective works side by side with the best private growth companies to make their equity compensation programs the basis of stable, long-term wealth creation for their employees

Enhance Recruitment and Retention

- Increase the value of equity compensation by providing controlled, turnkey liquidity

- Enable tax optimized diversification to reduce employee risk from over-concentration

- Deliver better long-term financial outcomes for employees

Eliminate Issues Posed by Other Solutions

- Provide employee liquidity without accepting many retail investors on to the cap table

- Avoid legal complexity, disclosures and expenses of tender offer programs

- Enable employees to borrow non-recourse at reasonable rates without encumbering their shares

Gain a Value Added, Long-term Investor

- Collective is a long-term institutional investor

- The Collective Exchange Fund is overseen by experienced venture capitalists

- Collective is passive shareholder that always seeks to support management

What is Collective Liquidity?

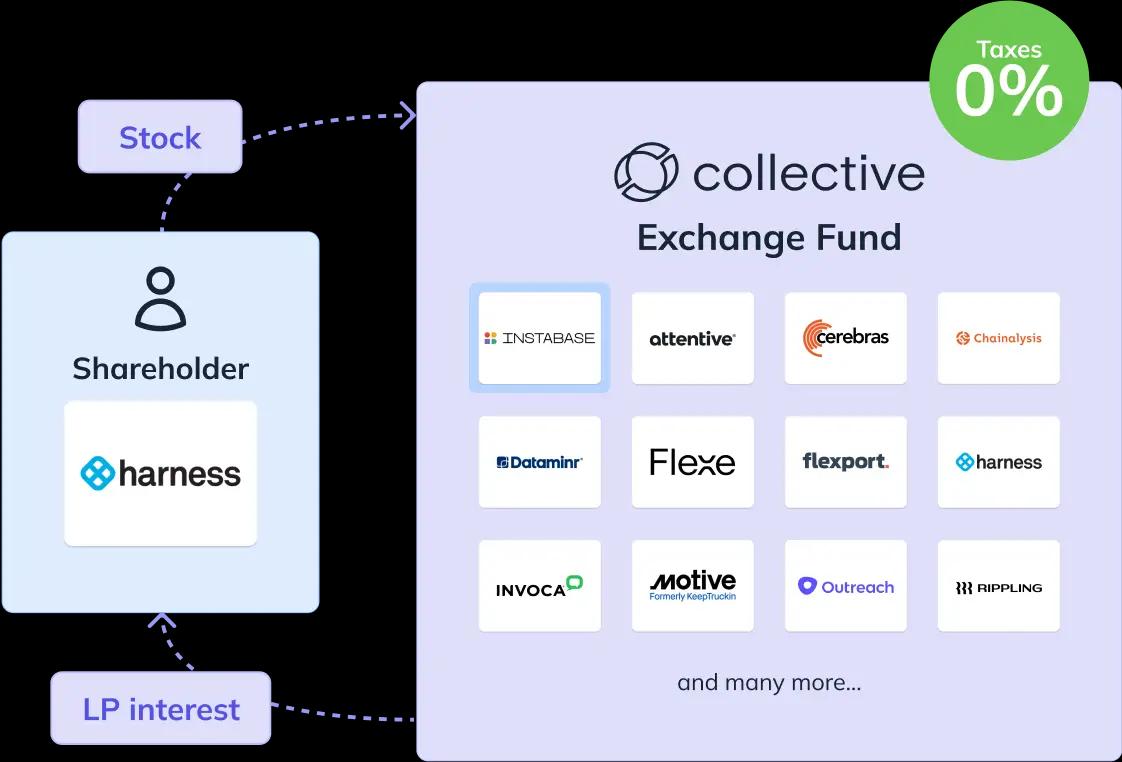

Collective Liquidity provides unicorn employees with the financial tools they need to turn their company’s equity compensation into a prudent, long-term financial plan. Collective does this first by enabling employees to exchange shares tax-free for an interest in the Collective Exchange Fund, a diversified portfolio of leading unicorns. They can then choose to obtain liquidity by borrowing non-recourse against their fund interest. As compared to a stock sale, the results for employees can be more liquidity in the near term and greater appreciation with less financial risk over the long-term.

What is the Collective Exchange Fund?

Exchange funds generally allow investors to exchange a single stock for an interest in a diversified pool without triggering capital gains taxes. They have been available for public shares for decades. Collective Liquidity is the first to make this proven diversification and tax optimization strategy available for private shares.

The Collective Exchange Fund aims to represent the unicorn asset category by applying a long-term, passive approach to a broadly diversified portfolio of unicorns. Collective only accepts exchanges from 100 leading unicorns backed by many of the best VCs into its portfolio. Prospective exchangers can learn exactly which companies are eligible for exchange by viewing the fund’s Target Portfolio

Questions?

Your Collective Customer Service Representative is here to answer questions and compare your different liquidity options

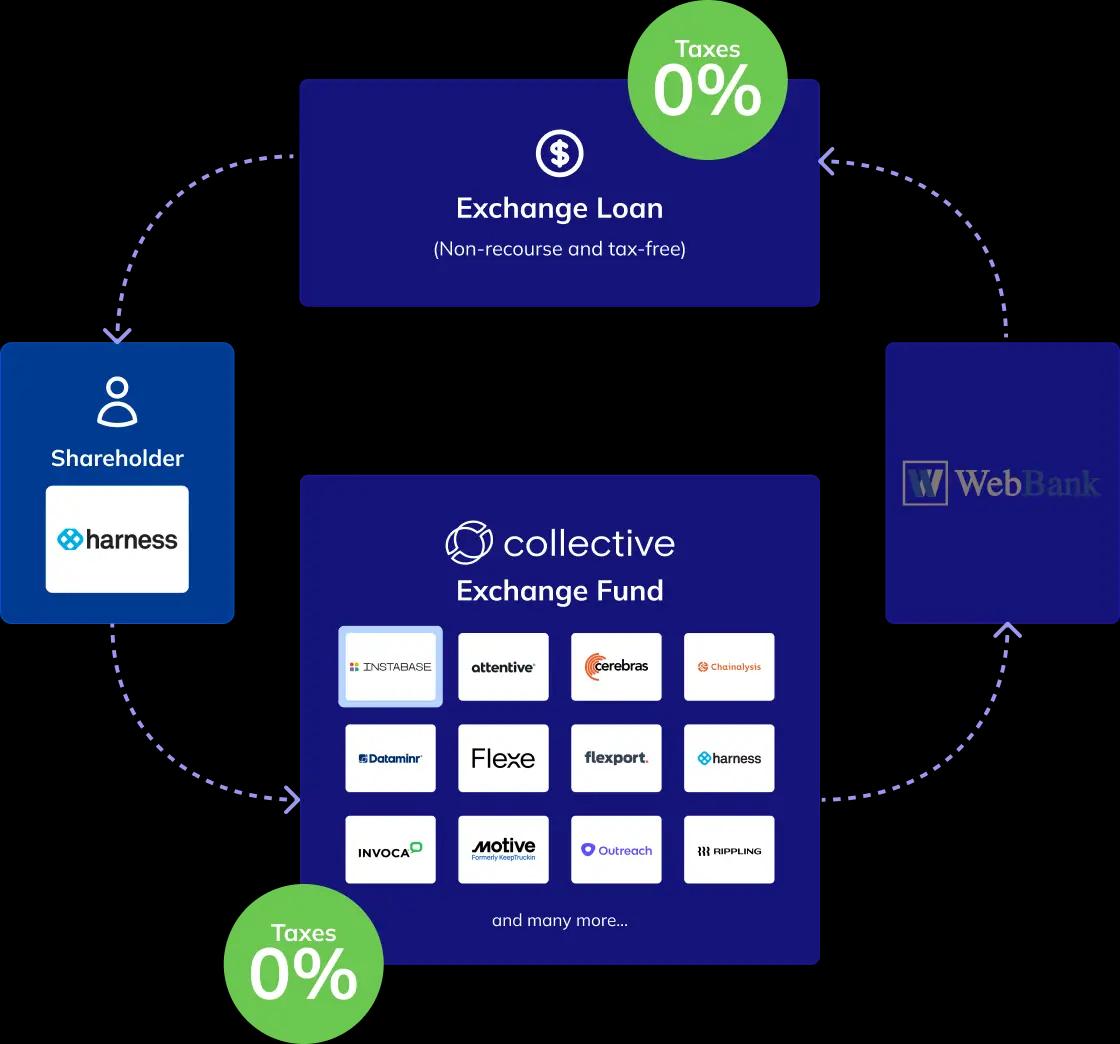

What is an Exchange Loan?

To provide exchanging shareholders with liquidity, Collective has partnered with WebBank. Shareholders can borrow against their fund interests on a non-recourse basis. Terms for these Exchange Loans are often substantially better than the typical non-recourse loans available to private company employees. Instead of loan-to-value ratios between 15-25%, Exchange Loans are for up to 65% of the value of the shareholder’s shares. Instead of charging 15-25% annual interest rates, Exchange Loans currently charge just 9.90%. Instead of taking up to 45% of the borrower’s stock at maturity, Exchange Loans charge no stock or equity fee.

Because both the exchange into the fund and the loan are tax free, many employees can generate more immediate after-tax liquidity from an Exchange Loan than they can obtain from a stock sale. Even better, the employee retains their Exchange Fund interest, generating long-term wealth on top of the near-term proceeds from their Exchange Loan.

Why is Collective Liquidity good for private growth companies?

The Collective Exchange Fund is a passive, long-term investor managed by experienced venture capitalists. Collective consolidates a company’s cap table by aggregating many smaller shareholders into a single institutional holder. As a long-term partner to our portfolio companies, we continually strive to be of service by delivering risk management and liquidity solutions that enhance the value of the company’s equity compensation plans. Our experienced staff ensures that Collective’s solutions are a turnkey employee benefit and conform to all company policies and procedures.

Why is Collective Liquidity a better liquidity provider than other solutions?

Unlike tender offer programs, Collective enables companies to avoid:

- Creating and managing complex liquidity programs

- Raising capital and making financial disclosures to fund employee liquidity

- Paying fees to tender offer platforms

Unlike marketplaces, Collective enables companies to avoid:

- Fragmenting their cap table with many unknown retail buyers

- Impacting 409A valuations (because exchanges are distinguishable from secondary transactions for valuation purposes)

Unlike stock lenders, Collective Liquidity enables companies to avoid:

- Letting their employees borrow at high cost

- Letting their employees remain over concentrated in a single stock

Jeff Nazzaro, Chief Capital Officer

Interested in learning more about the Collective Exchange Fund?

Please leave your contact information and a fund representative will contact you

Loading