Overview for Companies

This overview will introduce you to Collective Liquidity, a new wealth management platform for unicorn employees. It outlines the ways in which Collective works side by side with companies to make their equity compensation programs the basis of stable, long-term wealth creation for their employees

What is Collective Liquidity?

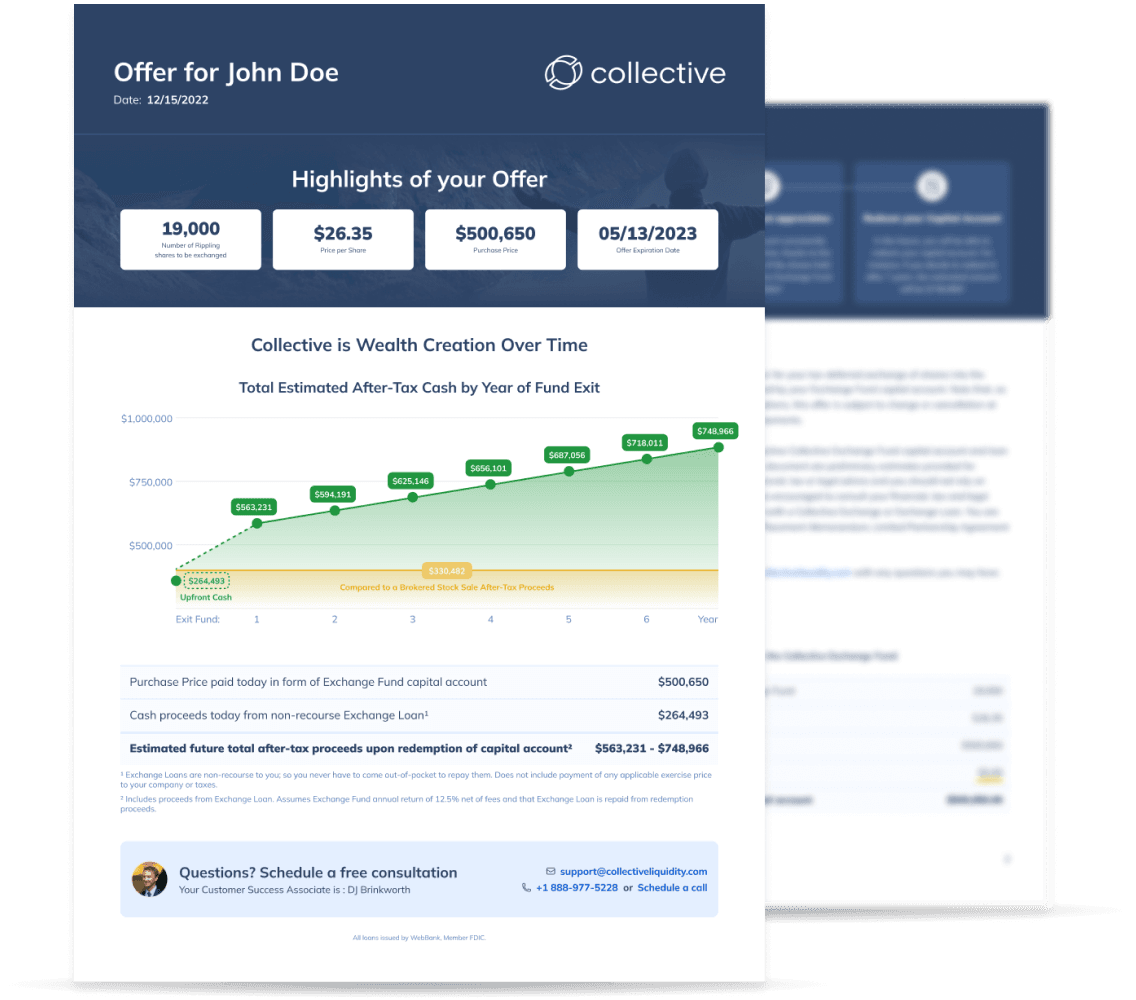

Collective Liquidity provides unicorn employees with the financial tools they need to effectively manage their wealth. Collective does this first by enabling employees to diversify tax free by exchanging their shares for a partnership interest in the Collective Exchange Fund, a diversified portfolio of leading unicorns. Employees that exchange into our fund also have the option to obtain liquidity by borrowing non-recourse against their fund interest at what can be significantly less than the cost typically charged by other non-recourse lenders. The results for employees can be substantially more after-tax diversification and liquidity over time than they could obtain from a stock sale.

What is the Collective Exchange Fund?

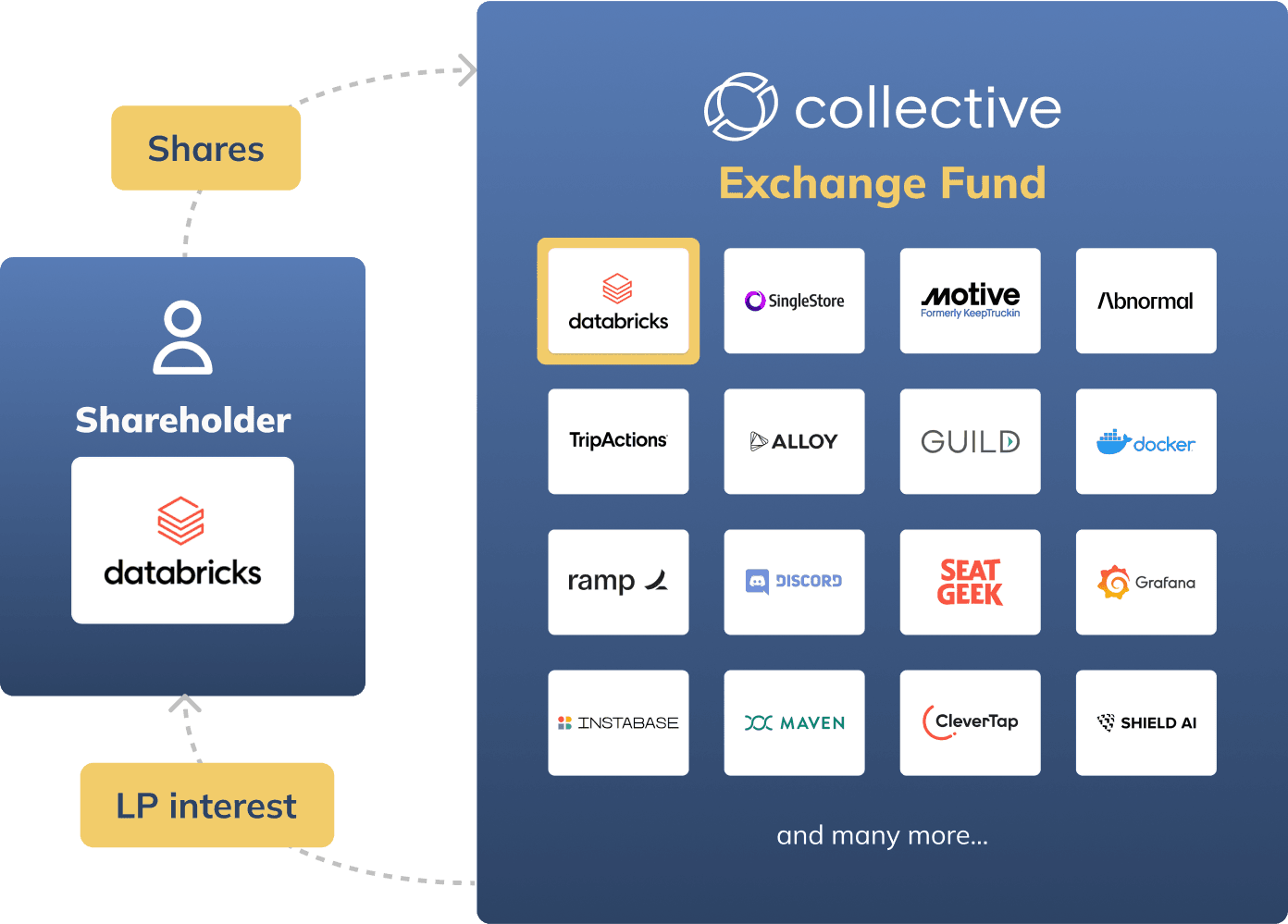

Exchange funds generally allow investors to exchange a single stock for an interest in a diversified pool without triggering taxes. They have been available for public shares for decades. Collective Liquidity is the first to make this proven diversification and tax optimization strategy available for private shares.

The Collective Exchange Fund aims to represent the unicorn asset category by applying a long-term, passive approach to a broadly diversified portfolio of unicorns. Collective only accepts exchanges from 100 leading unicorns backed by the best VCs into its portfolio. Prospective exchangers can learn exactly which companies are eligible for exchange by viewing the fund’s Eligible Companies on the Collective website.

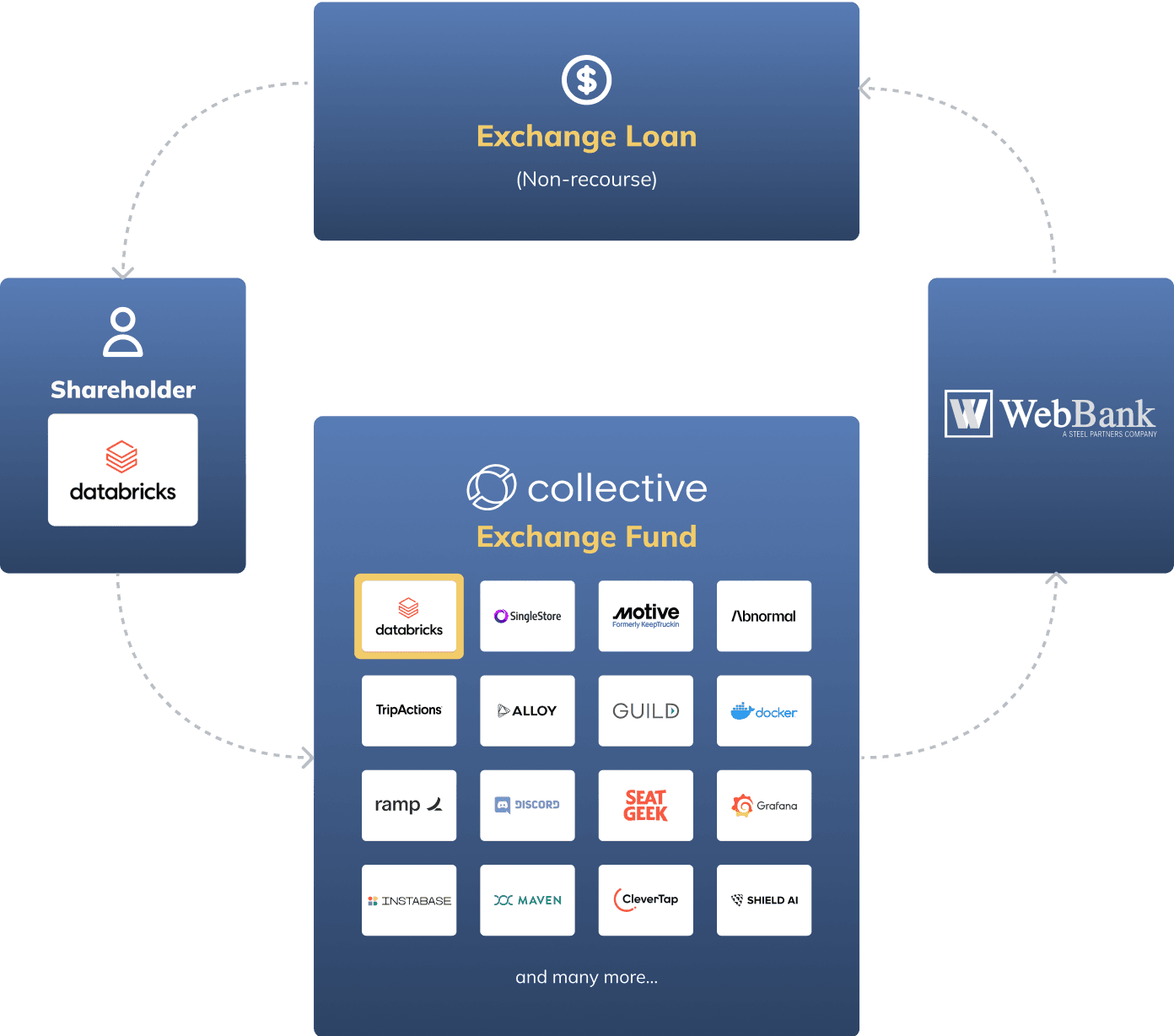

What is an Exchange Loan?

To provide exchanging shareholders with liquidity, Collective Liquidity has partnered with WebBank to enable shareholders to borrow against their fund interests on a non-recourse basis. Terms for these Exchange Loans are often substantially better than the typical non-recourse loan available to private company employees. Instead of loan-to-value ratios between 15-25%, Exchange Loans are for up to 65% of the value of the shareholder’s shares. Instead of charging 15-25% annual interest rates, Exchange Loans currently charge just 9.90%. Instead of taking up to 45% of the borrower’s stock at maturity, Exchange Loans charge no stock or equity fee.

Because both the exchange into the fund and the loan are tax free, many employees can generate more immediate after-tax liquidity from an Exchange Loan than they can obtain from a stock sale. Even better, the employee retains their Exchange Fund interest, generating long term wealth on top of the near-term proceeds from their Exchange Loan.

Why is Collective Liquidity good for private companies?

The Collective Exchange Fund is a passive, long-term investor that will provide employees with liquidity during a company’s time as a private company. Collective consolidates a company’s cap table by aggregating many smaller shareholders into one institutional holder. As a long-term partner to our portfolio companies, we continually strive to be of service by delivering risk management and liquidity solutions that unlock the value of their equity compensation plans. Our experienced staff ensures that Collective transactions conform to a company’s policies and procedures and every transaction is handled professionally.

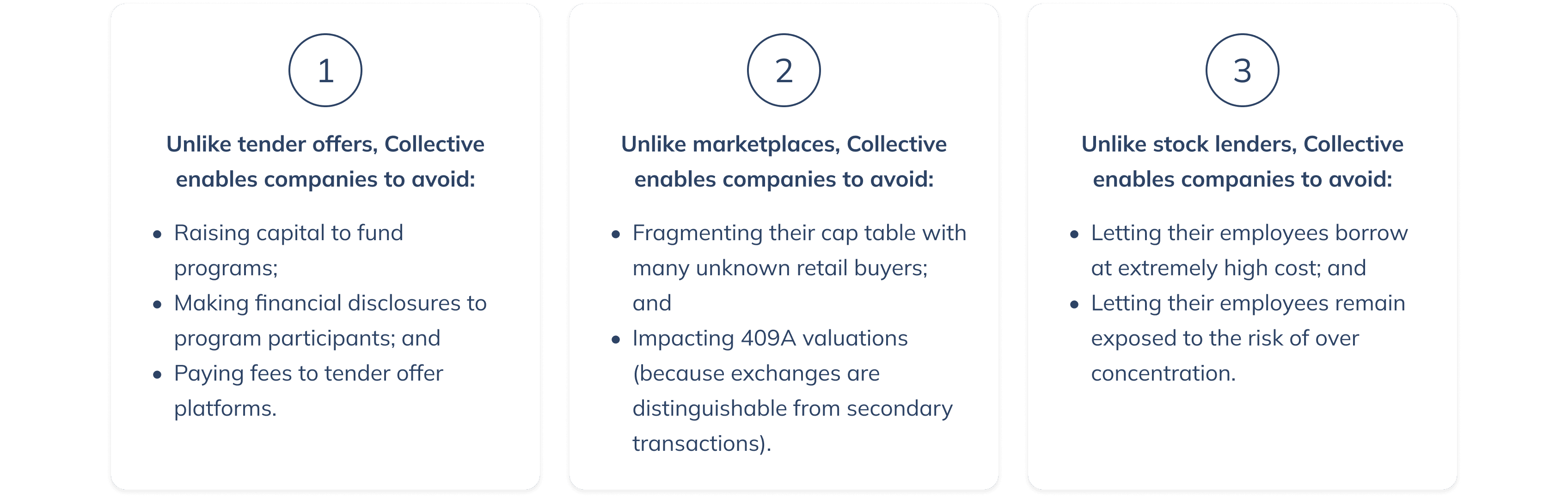

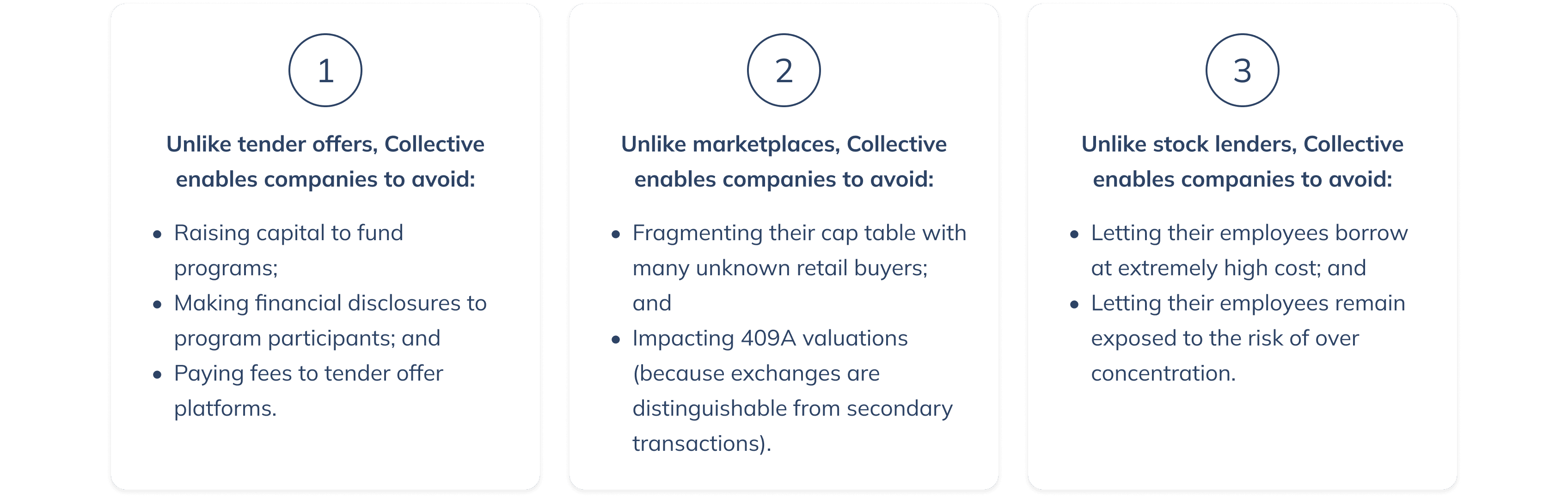

How does Collective compare to other liquidity solutions?

Who is behind Collective Liquidity?

The Collective Liquidity team is made up of the founders, executives and investors behind some of the private market’s most innovative secondary platforms. We are leveraging everything we learned along the way to deliver unicorn employees dramatically better liquidity and risk management solutions – solutions that enable them to finally and fully unlock the value they helped create.

Disclaimer

All loans issued by WebBank, Member FDIC.

This information relating to the Collective Exchange Fund, LP (the “Fund”) has been prepared solely for informational purposes, is not complete, and does not contain certain material information about the Fund, including important disclosures and risk factors associated with an investment in the Fund, and is subject to change without notice. It does not constitute an offer to buy or sell an interest in the Fund, nor shall there be any sale of a security in any jurisdiction where such solicitation or sale would be unlawful.

The Fund’s limited partnership interest will not be registered with the U.S. Securities Exchange Commission or other regulatory authority. Investors will be required to verify their status as an “Accredited Investor” pursuant to Rule 501 of Regulation D to participate in any offering of the Fund’s limited partnership interests. No securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through Collective Liquidity, Inc. or Collective Asset Management, LLC (collectively, “Collective Liquidity”).

Limited partnership interests in the Fund are not insured by the FDIC and are not deposits or other obligations of Collective Liquidity and are not guaranteed by Collective Liquidity. Limited partnership interests in the Fund are subject to investment risks, including possible loss of the principal invested.

Prospective investors should consider the investment objectives, risks, fees and expenses of the Fund carefully before investing in the Fund. This and other important information are contained in the Fund’s Confidential Private Placement Memorandum (“PPM”), which can be obtained by contacting Collective Liquidity.

Investment in the Fund involves substantial risk and any offering may only be made pursuant to the relevant PPM and the relevant subscription application, all of which must be read in their entirety. No offer to purchase securities will be made or accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. The Fund has no history of public trading and investors should not expect to sell limited partnership interests in the Fund. No secondary market exists for the Fund’s limited partnership interests, and none is expected to develop. The Fund has a limited operating history, and its performance is highly dependent upon the expertise and abilities of its manager. There is no assurance that the Fund’s investment objectives will be achieved, and results may vary substantially over time. This is not a complete enumeration of the Fund’s risks. Please read the Fund’s PPM for other risk factors related to the Fund. Although the manager of the Fund will value its portfolio using the Private Market Valuation Algorithm, it can be difficult to obtain financial and other information with respect to private companies, and even where the manager is able to obtain such information, there can be no assurance that it is complete or accurate. Because such valuations are inherently uncertain and may be based on estimates, the manager’s determinations of fair market value may differ materially from the values that would be assessed if a readily available market for these securities existed.

The information contained herein does not constitute a recommendation or advice by Collective Liquidity. You should consult your own tax, legal, accounting, financial or other advisers about the information discussed herein based on your specific risk profile and financial situation, including the suitability of an investment in the Fund, with Collective Liquidity, or any product offered or managed by Collective Liquidity.

Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.