Introducing Exchange Loans

Employees of late-stage, venture backed private companies (“unicorns”) often find it difficult to obtain liquidity for their hard-earned stock and options. They can try to find a buyer on an online marketplace, but, even if a buyer is found, it typically requires lengthy negotiations and half the proceeds can go to pay taxes and commissions. There are lenders that make loans against shares but they generally lend only a small percentage of the value of the stock and their fees can be prohibitive.

Now Collective Liquidity is making a new, better solution available. Exchange Loans provide unicorn employees with both immediate liquidity and long-term wealth creation:

More Upfront Cash. Exchange Loans can generate more immediate after-tax liquidity than the alternatives.

Long-Term Wealth Creation. Exchange Loans come with a partnership interest in a portfolio of leading unicorns.

Quick and Easy. Exchange Loans can fund within 3 days of shares transferring into the Exchange Fund.

Riskless. Exchange Loans are non-recourse so you never have to come out of pocket to repay them.

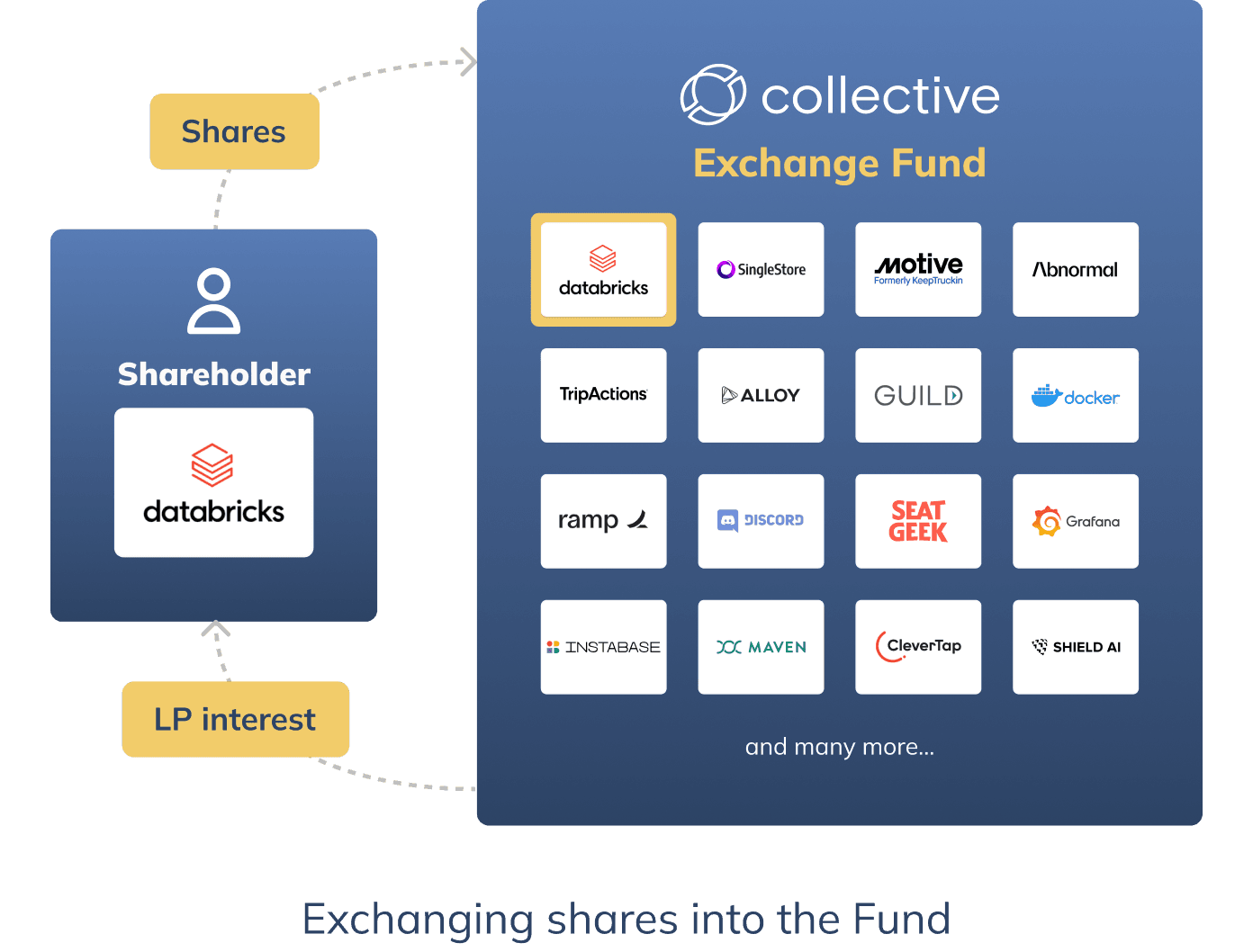

How it works

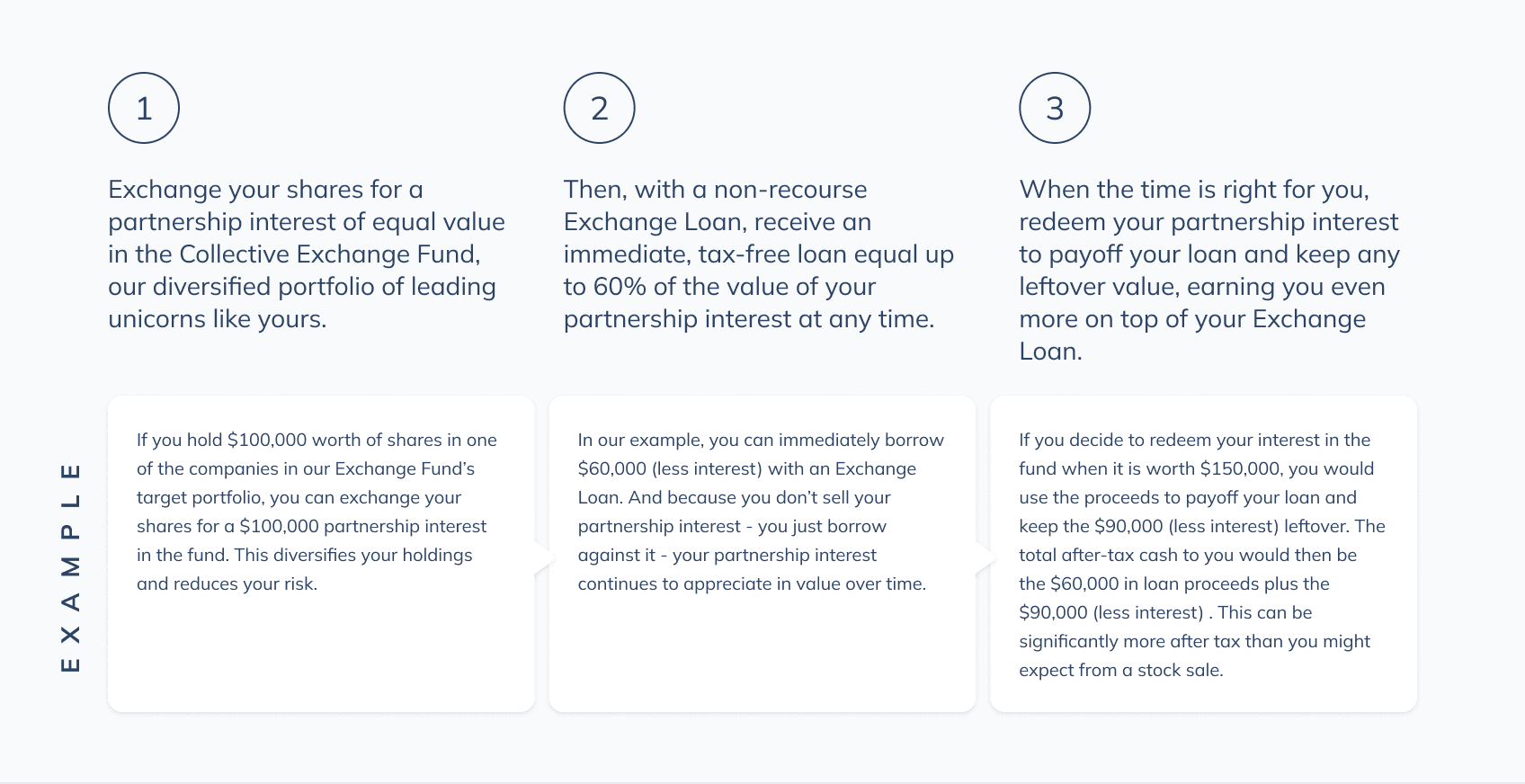

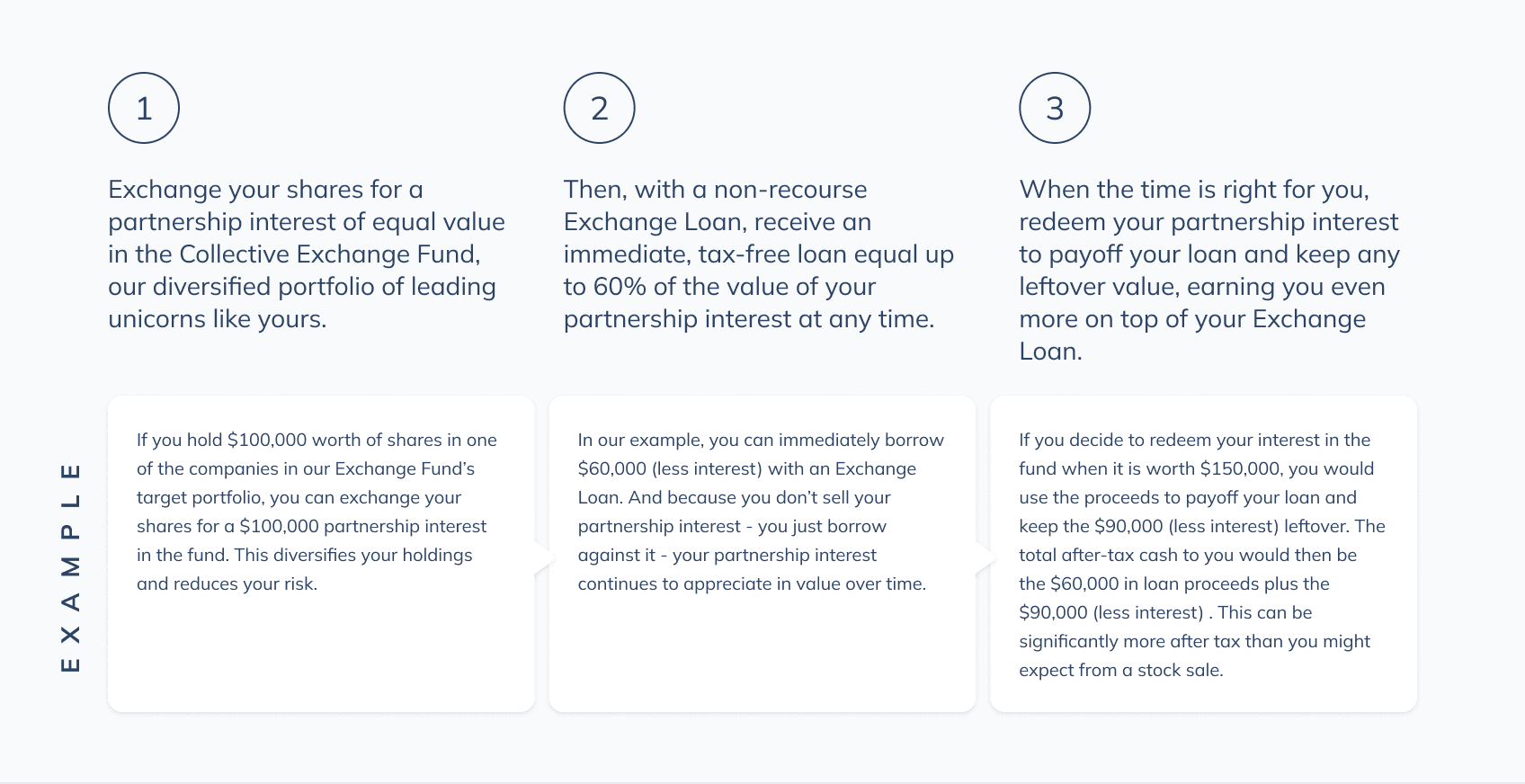

Unicorn shareholders obtain liquidity from Exchange Loans in two easy steps. First, they exchange shares into the Collective Exchange Fund, a portfolio of leading unicorns, for a limited partnership interest of equal value. Then they borrow against that partnership interest to generate immediate cash. Whenever they wish to exit the Exchange Fund, they redeem their partnership interest for cash, using the proceeds to payoff their loans and keep whatever is left over.

For example:

Tax Deferral

Unlike stock sales that are typically taxed at state and federal ordinary income rates as high as 46%, exchanges of stock into the Fund and Exchange Loans do not trigger a tax obligation. As a result, many unicorn shareholders get more after tax liquidity from an Exchange Loan than they’d receive from a stock sale.

Non-Recourse

Exchange Loans are non-recourse to the borrower. In the event the value of your Exchange Fund partnership interest becomes less than the outstanding amount of your loan, you can always choose to turn over your partnership interest to satisfy all of your obligations to the lender. You never need to come out of pocket to repay an Exchange Loan.

Redemption of Partnership Interest

After the first year, you can redeem your Exchange Fund partnership interest for cash at the end of any quarter. Proceeds from your redemption payoff your Exchange Loan and you keep whatever is left over. This is why an Exchange Loan provides both immediate cash and the opportunity for long term wealth creation

Loan Terms

- Loan Amount: 60% of value of Exchange Fund partnership interest

- Interest rate: 9.9% annually

- Interest payments: reserved from loan proceeds; no monthly payments

- Loan origination fee: 2% of loan amount

- Stock fee: none

- Prepayment penalty: none

- Term: 1 year; refinancing available

Payments and Payoff

All of the interest on an Exchange Loan is collected upfront so there are no monthly payments. If you prepay your loan, the unused portion of the amount reserved is refunded to you. When your Exchange Loan matures, you can repay it by refinancing it on Collective, redeeming your partnership interest or paying cash.

About Collective

At Collective Liquidity, we are dedicated to providing unicorn shareholders with the financial tools they need to effectively manage their wealth. Over the past decade, our team has launched some of the private market’s largest, most innovative platforms. Now, we are leveraging everything we learned along the way to deliver unicorn employees and investors with dramatically better access to liquidity and risk management solutions – solutions that enable them to finally and fully unlock the value they helped create.

Disclaimer

All loans issued by WebBank, member FDIC.

Note that an investor who does an in-kind contribution of shares to the Exchange Fund, will likely have a lower tax basis than an investor who sells their stock and reinvests the proceeds. Investment management and performance fees and expenses incurred with respect to any investment may reduce returns. All tax calculations are estimates and are not meant as tax planning or investment advice. Consult your tax professional about your individual circumstances.

This information relating to the Collective Liquidity Exchange Fund (the “Fund”) has been prepared solely for informational purposes, is not complete, and does not contain certain material information about the Fund, including important disclosures and risk factors associated with an investment in the Fund, and is subject to change without notice. It does not constitute an offer to buy or sell an interest in the Exchange Fund, nor shall there be any sale of a security in any jurisdiction where such solicitation or sale would be unlawful. The Fund’s limited partnership interest will not be registered with the U.S. Securities Exchange Commission or other regulatory authority. Investors will be required to verify their status as an “Accredited Investor” to participate in any offering of the Fund’s limited partnership interests. No securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through Collective Liquidity.

Limited partnership interests in the Fund are not insured by the FDIC and are not deposits or other obligations of Collective Liquidity Asset Management, LLC or any of its affiliates (collectively, “Collective Liquidity”) and are not guaranteed by Collective Liquidity. Limited partnership interests in the Fund are subject to investment risks, including possible loss of the principal invested.

Prospective investors should consider the investment objectives, risks, fees and expenses of the Fund carefully before investing in the Fund. This and other important information are contained in the Fund’s Confidential Private Placement Memorandum (“PPM”), which can be obtained by contacting Collective Liquidity.

Investment in the Fund involves substantial risk and any offering may only be made pursuant to the relevant PPM and the relevant subscription application, all of which must be read in their entirety. No offer to purchase securities will be made or accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. The Fund has no history of public trading and investors should not expect to sell limited partnership interests in the Fund. No secondary market exists for the Fund’s limited partnership interests, and none is expected to develop. The Exchange Fund has a limited operating history, and its performance is highly dependent upon the expertise and abilities of its manager. There is no assurance that the Exchange Fund’s investment objectives will be achieved, and results may vary substantially over time. This is not a complete enumeration of the Fund’s risks. Please read the Fund’s PPM for other risk factors related to the Fund. Although the manager of the Exchange Fund will value its portfolio using the Private Market Valuation Algorithm, it can be difficult to obtain financial and other information with respect to private companies, and even where the manager is able to obtain such information, there can be no assurance that it is complete or accurate. Because such valuations are inherently uncertain and may be based on estimates, the manager’s determinations of fair market value may differ materially from the values that would be assessed if a readily available market for these securities existed.

Collective Liquidity does not provide legal or tax advice, nor is this communication any form of investment advice to the recipients. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns. The information contained herein is for informational purposes only. This material contains the current opinions of Collective and such opinions are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.