Carta tutorial: how to get option exercise costs and estimated taxes

A step by step tutorial on how to use your Carta account to receive estimates for your options exercise costs and estimated taxes

A. Log in to your Carta account and navigate to the Portfolio page.

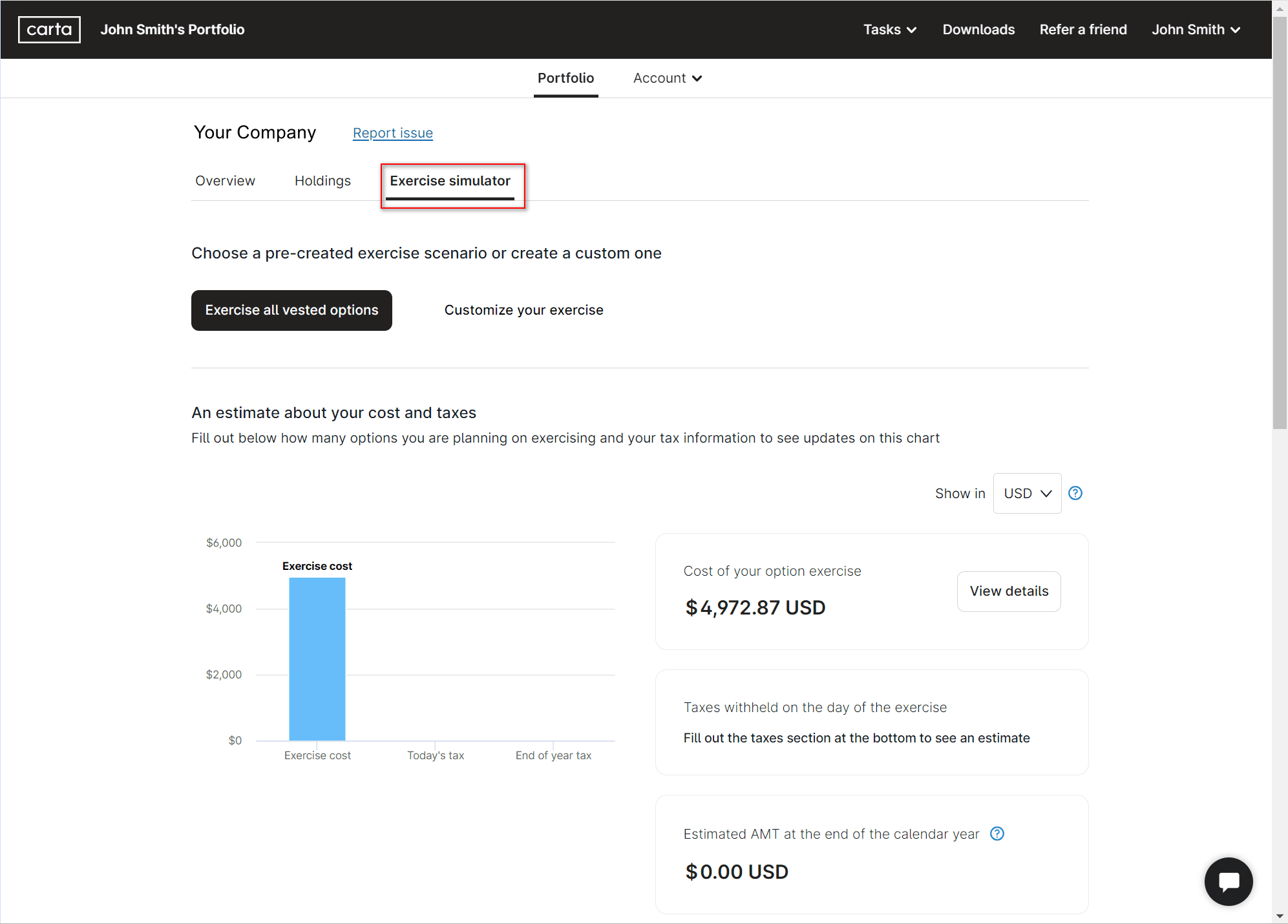

B. Select the desired company and click on Exercise Simulator:

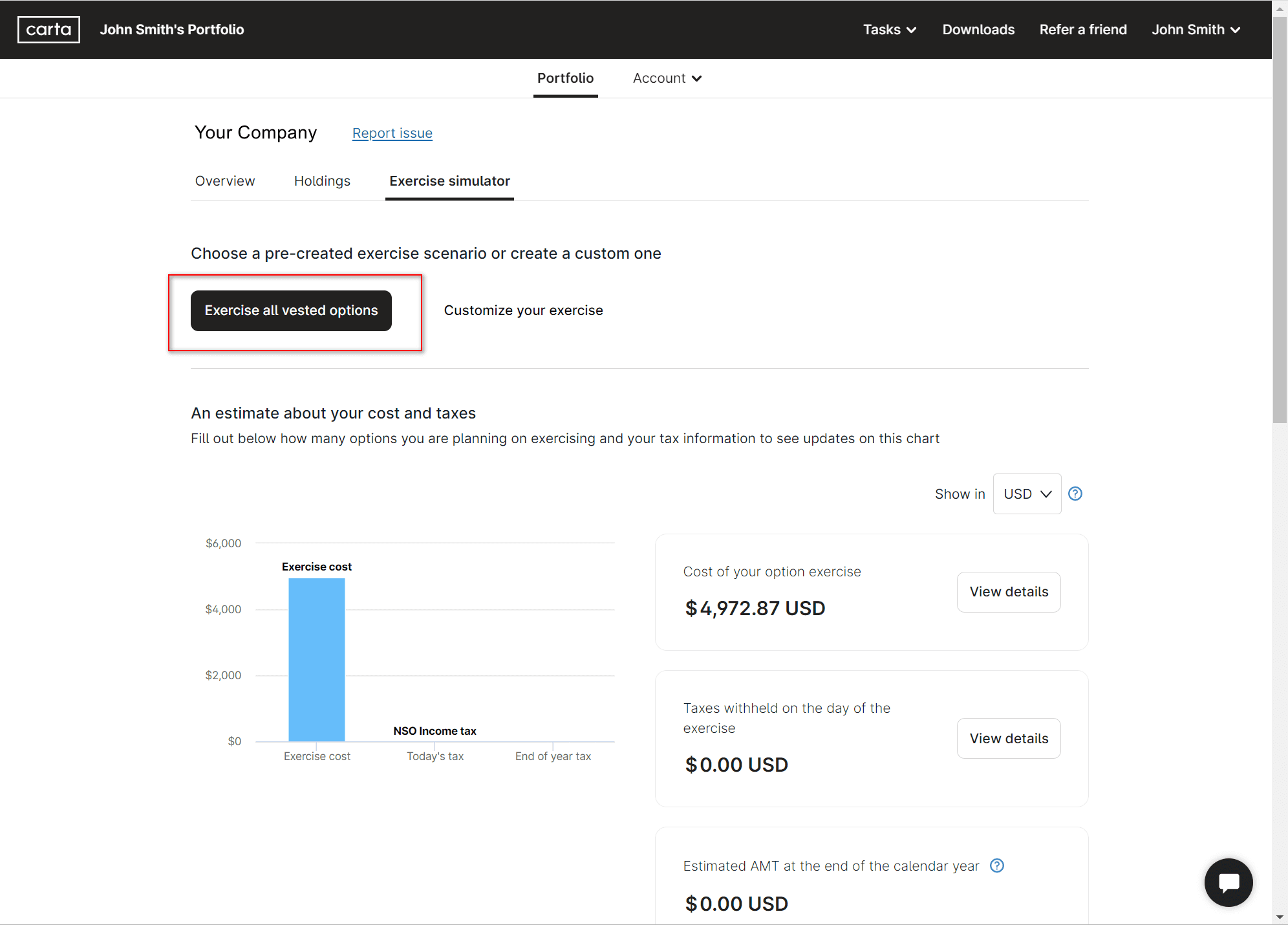

C. Choose a pre-created exercise scenario or create a custom scenario:

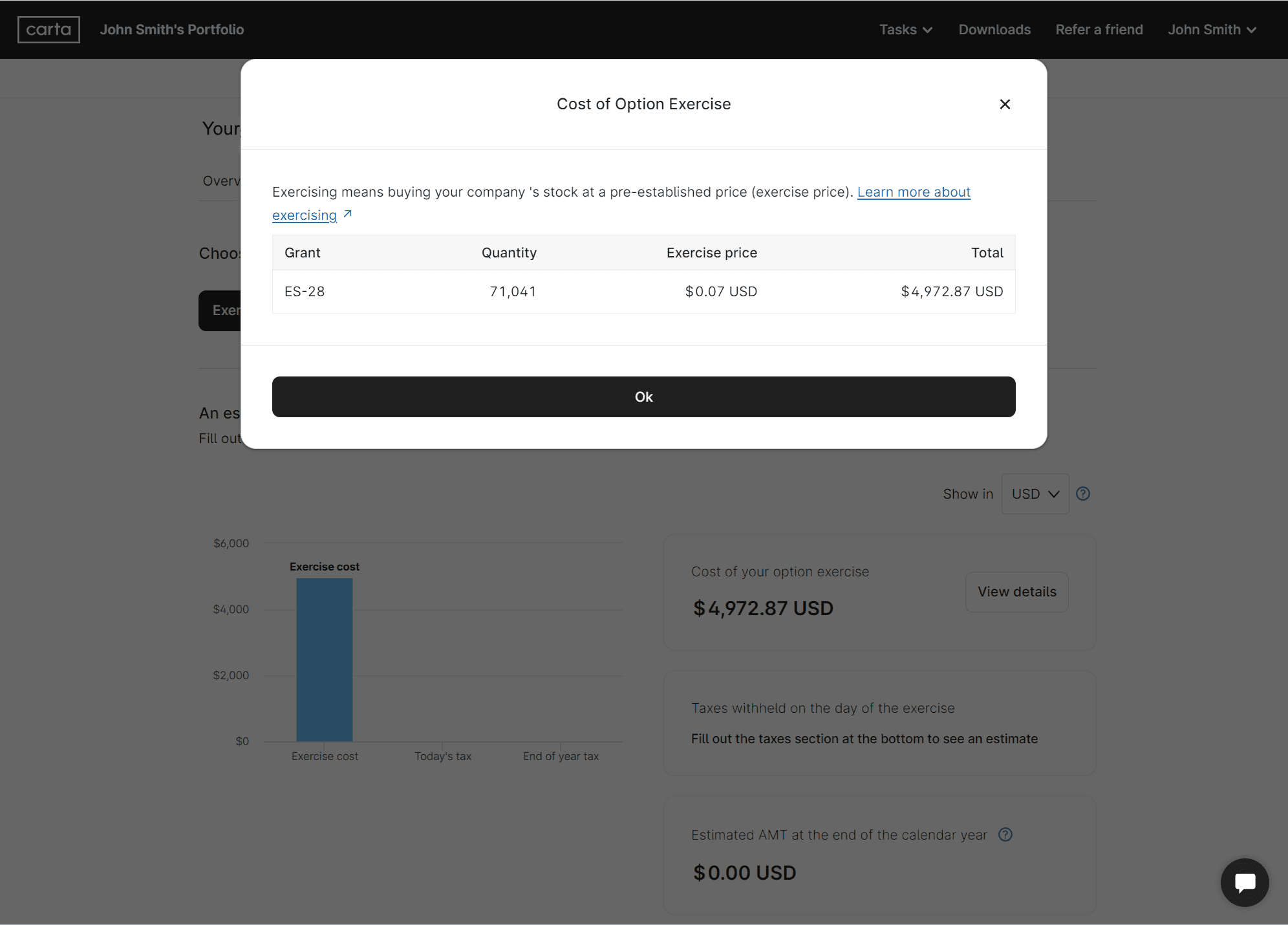

D. Clicking on Exercise all vested options will provide an estimate about your cost and taxes applied on your option exercise. By clicking on View Details, all options that were considered for the exercise cost will appear. A preview of the pre-tax cost (quantity * exercise price) will appear as an example:

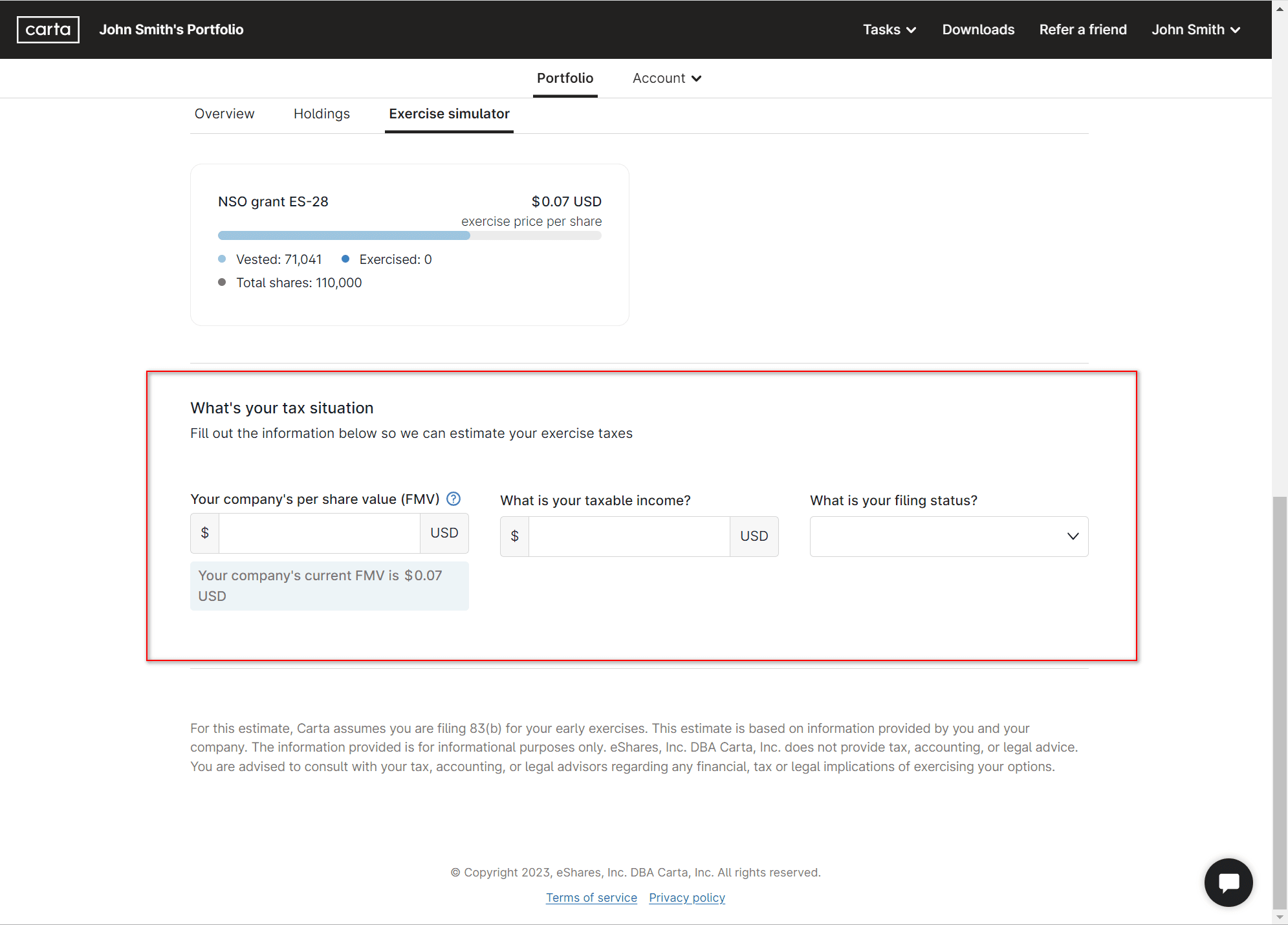

E. To estimate the taxes on your exercise, scroll down to “What's your tax situation”, and fill out the information. For “Your company's per share value (FMV)” please fill Your company’s Fair market value (FMV), which is the per share price of your company’s common stock. Usually, the current FMV will already be known to Carta as you can see in the example below (see comment below the field):

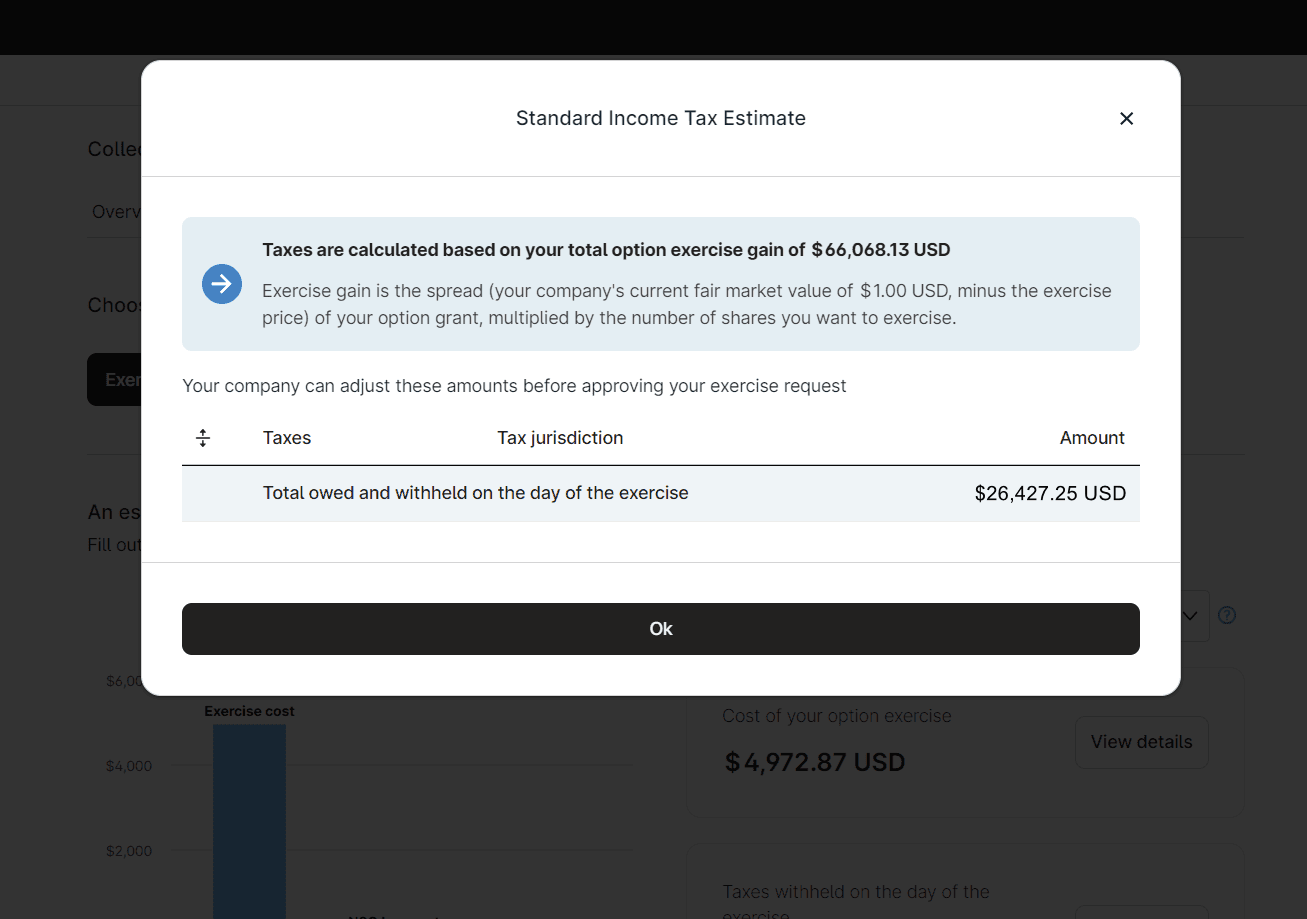

F. Then, scroll up and click “View details” next to “Taxes withheld on the day of the exercise. Your tax estimate breakdown will open in a new window: