About the Exchange Fund

The Collective exchange Fund provides employees of selected private growth companies with a unique, tax-advantaged way to reduce their financial risk, gain liquidity and build long-term wealth

A selection of our portfolio companies: See our Target Portfolio

Portfolio Company Selection

Only shares of companies in the Collective Liquidity Fund’s Target Portfolio are eligible for exchange into the Fund. Companies are selected for the Target Portfolio by the Collective Investment Committee ("IC"). Comprised of experienced, accomplished venture capitalists, the IC first screens U.S. private growth companies valued at over $1B by a number of objective criteria including the backing of certain recognized venture capital firms. The IC then reviews the remaining companies, selecting those that have the best risk adjusted opportunities for long term value creation. Collective's Target Portfolio is updated continuously and always viewable on the Portfolio page of the Collective website.

Many of the most successful VCs are invested in our Target Portfolio companies: Learn more

Questions?

Your Collective Customer Service Representative is here to answer questions and compare your different liquidity options

Diversification of Assets and Equities

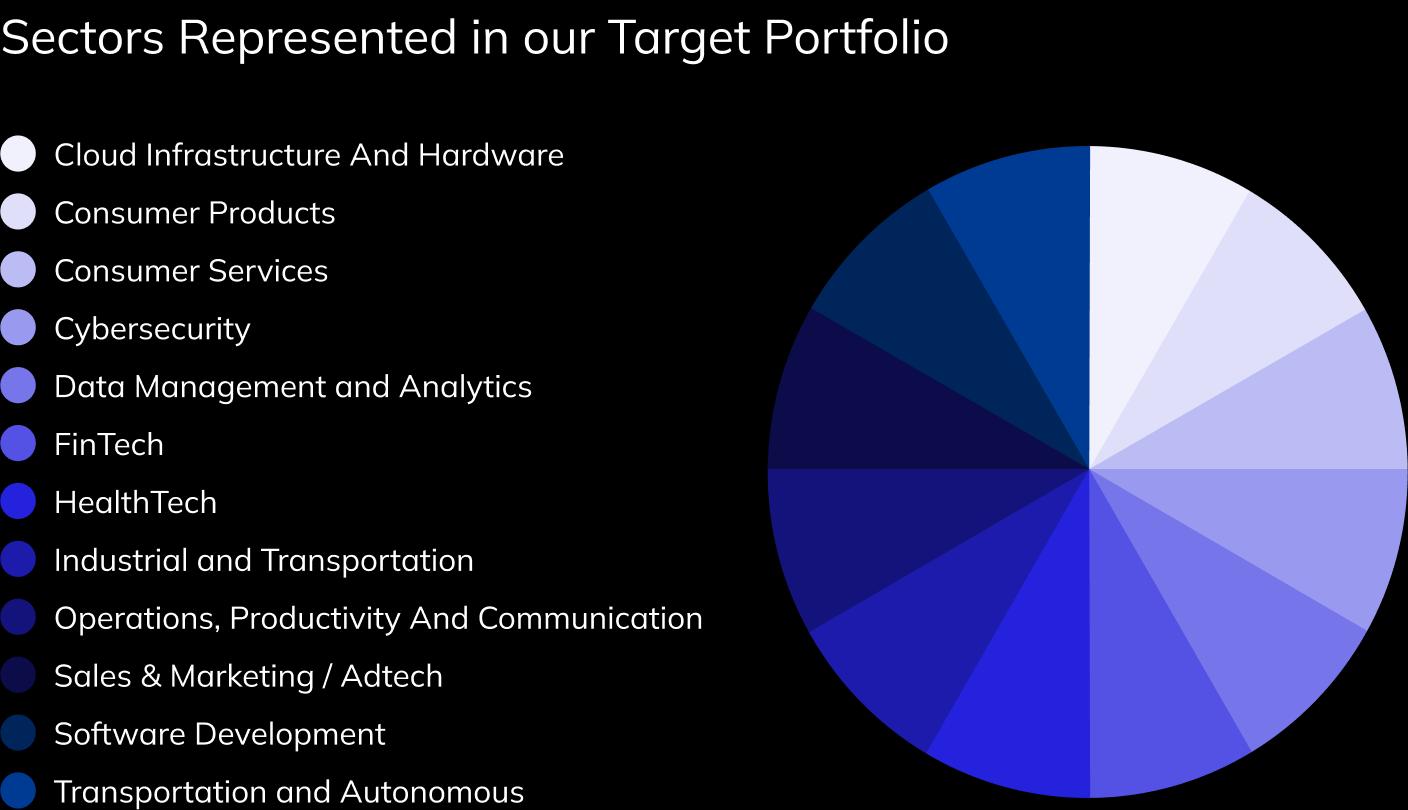

The Collective Exchange Fund's assets are primarily in the form of unicorn stock but also include cash and partnerships in real estate investment funds. The Fund's stock is diversified across technology industry sectors and individual companies within those sectors. Over time, the Fund will target a maximum allocation to any industry sector of 20% of Fund assets and a maximum allocation to any single company of 5%. The Fund holds real estate assets to enhance its diversification and to preserve the favorable tax treatment for exchangers into the Fund under the U.S. tax code. The holdings of the real estate investment funds are generally mature, stable properties diversified across types (e.g., residential, industrial, etc.) and across U.S. regions.

Exchange Fund Target Exposure:

75%

Unicorn Equity

20%

Real Estate

5%

Cash

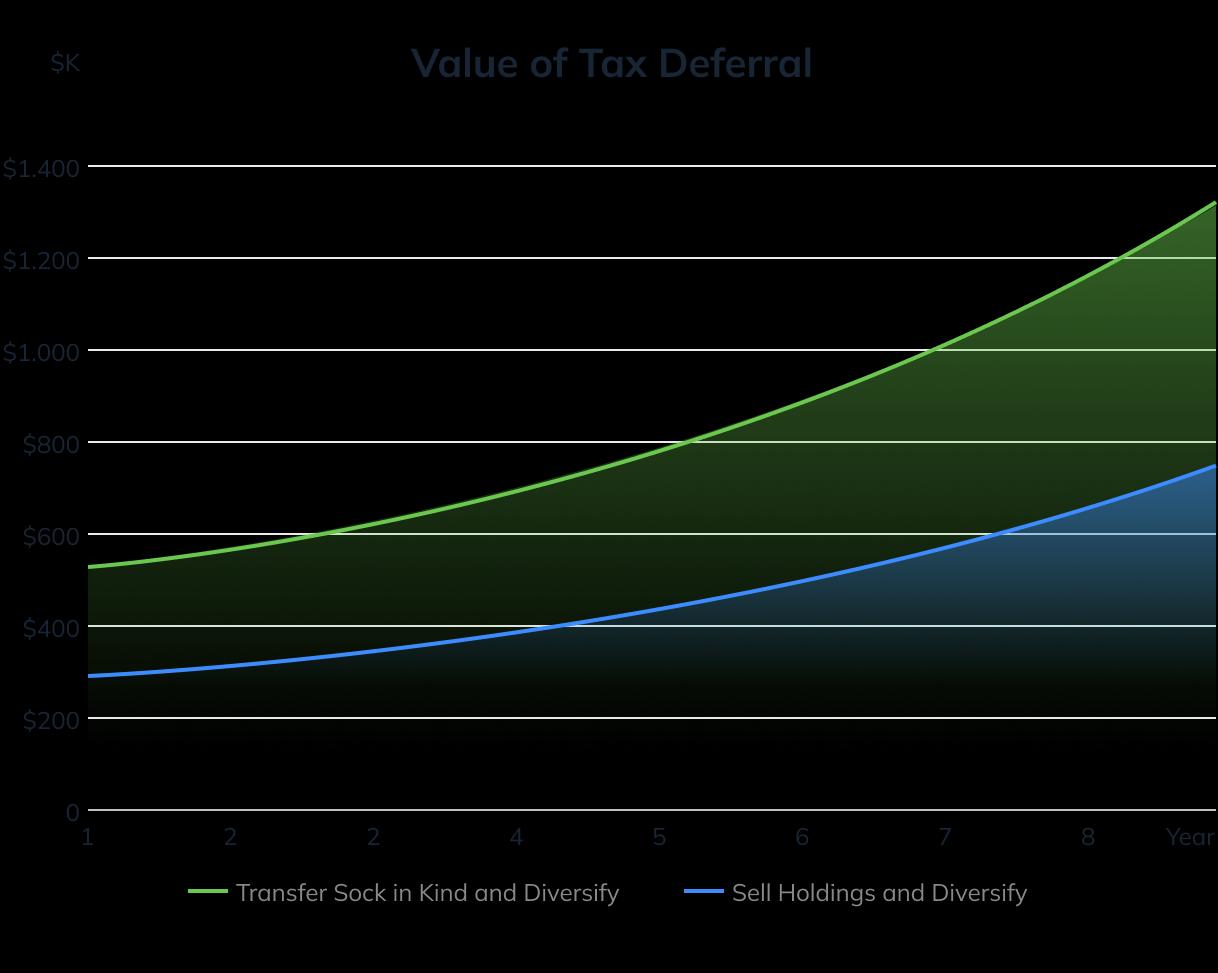

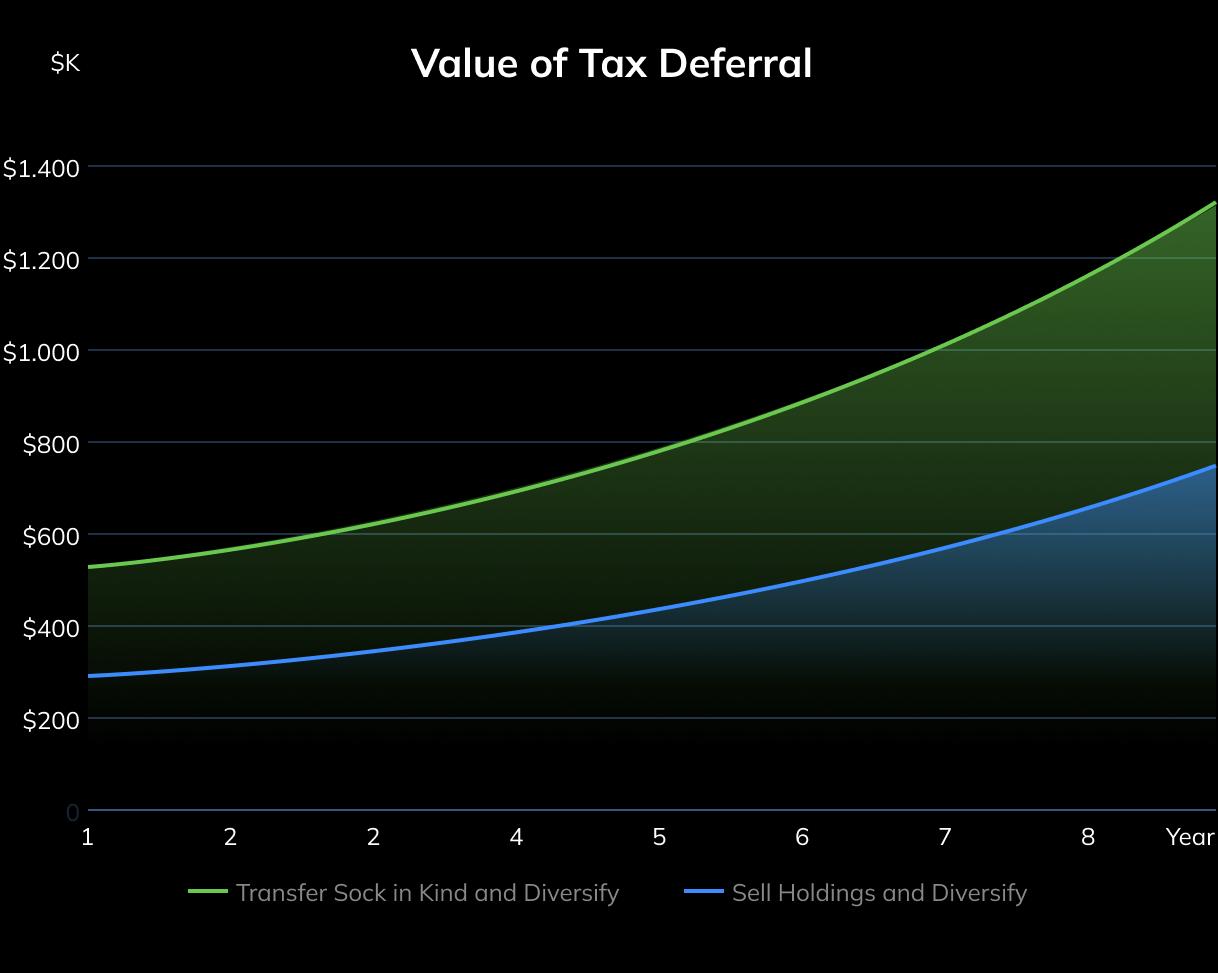

Tax Advantages for Exchangers

There are potentially significant advantages to diversifying by exchanging into the Fund versus diversifying with the after-tax proceeds from a share sale. In the latter case, the shareholder must pay state and federal capital gains taxes and brokerage fees amounting to as much as half of their gross sales proceeds. So, for every dollar of shares they sell, they can only purchase $0.50 worth of diversifying assets. With an exchange fund, however, the shareholder incurs neither capital gains tax nor brokerage fees and receives a $1.00 worth of a diversified portfolio for every $1 worth of their shares. Over time, the difference in outcomes between the two approaches can be dramatic.

This hypothetical illustration shows a $630,000 (90%) difference in value over time between (a) selling shares and investing the after-tax proceeds in a diversified portfolio vs. (b) exchanging on a tax deferred basis into a diversified portfolio. It makes the following assumptions:

- The stock has been held less than a year by a California resident and has a current value of $500,000 with a tax basis of $50,000

- Applicable federal tax rate is 35%; state tax rate is 11%; brokerage fee on stock sale is 6%

- The return on both the proceeds from the “Sell Holdings and Diversify” and the exchange approaches is 15% annually net of management and/or performance fees

See additional important disclosures regarding this chart here

"

Diversification is the only free lunch in finance.

Harry Markowitz, Nobel Prize-winning economist

Questions?

Your Collective Customer Service Representative is here to answer questions and compare your different liquidity options

The Collective Valuation Algorithm

Collective’s proprietary Private Market Valuation Algorithm dynamically prices unicorn shares and allocates capital across the Target Portfolio for the purpose of:

- Pricing fund exchanges and purchases

- Establishing loan-to-value ratios

- Identifying net asset values

- Valuing limited partnership interests for quarterly redemptions

The algorithm is designed to output real time valuations of unicorn shares representative of the current market clearing price (as opposed to determining the company's intrinsic or future value based on fundamental analysis). As a result, the Fund's limited partners have transparency into the value of their capital accounts that is unique in the venture capital industry.

Redemption

To provide its limited partners with liquidity, the Collective Exchange Fund permits redemptions of limited partnership interests at the end of each quarter. After a one-year hold, a limited partner may typically submit a redemption request for some or all of their interest in the Fund. Fund interests are redeemed for cash at a purchase price implied by the fund's Net Asset Value at the end of the quarter. The fund's redemption obligations in any given quarter are limited to four percent of the fund's Net Asset Value.

Reduce Risk by Diversifying

Reduce your risk from being over-concentrated in a single stock by exchanging into a diversified portfolio of leading unicorns like yours. Better still, do it without triggering capital gains tax.

Liquidity When You Need It

When they need liquidity, limited partners of the Exchange Fund can borrow non-recourse against their interest in the fund. They can also redeem their partnership interest for cash after the first year.

Speed and Convenience

Compared to a stock sale which requires you to connect with a broker, find a buyer, negotiate price, and draft transaction documents, an Exchange Loan is fast and easy. The online application process takes just five minutes to complete.

Risks of the Collective Exchange Fund

Investments in private growth companies are inherently risky and there are also potential risks specific to exchange funds. Some of these risks include:

- Performance is not guaranteed. It is possible that the position(s) a shareholder contributed to the Fund will outperform the Fund's portfolio. The Fund may also fail to match the performance of the overall late-stage, private growth asset category.

- Liquidity may be restricted. Though the Fund offers quarterly redemptions to its limited partners beginning on the first anniversary of their contribution, such redemptions are subject to restrictions in some circumstances. These restrictions are described in detail in the Fund's Private Placement Memorandum and other subscription documents.

- Tax laws are subject to change. Although any change to the favorable treatment exchange funds receive would most likely be grandfathered in for current investors, it is possible that taxing authorities could elect to make such changes retroactive.

- Fees can impact returns. The Exchange Fund charges annual management and performance fees, which can have a material impact on performance.

- Real estate assets are included in the fund. Exchange funds generally need to invest at least 20% of fund assets in certain non-security investments—usually satisfied by purchasing real estate. These assets may adversely impact performance, increase risk and expose the fund to interest rate movements.

For a more complete description of these risks and a description of other risks related to an investment in the Collective Liquidity Fund, please review the Fund's Private Placement Memorandum, available from Collective Liquidity.

Disclosures

For the chart titled “Value of Tax Deferral,” the assumed growth rate for both the diversified portfolios acquired with the proceeds of the stock sale and the Exchange Fund of net 15% per year is a hypothetical and is used only to illustrate the potential benefits of tax deferral. It does not represent the past or future performance of any investment. The chart is provided for discussion purposes only and should be viewed as merely representative of a range of possible outcomes. This chart should not be construed as providing any guarantee as to returns from an investment in the Exchange Fund. Note also that an investor who does an in-kind contribution of shares to the Exchange Fund, will likely have a lower tax basis than an investor who sells their stock and reinvests the proceeds. Investment management and performance fees and expenses incurred with respect to any investment may reduce returns. All tax calculations are estimates and are not meant as tax planning or investment advice. Consult your tax professional about your individual circumstances.

This information relating to the Collective Liquidity Fund, LP (the “Fund”) has been prepared solely for informational purposes, is not complete, and does not contain certain material information about the Fund, including important disclosures and risk factors associated with an investment in the Fund, and is subject to change without notice. It does not constitute an offer to buy or sell an interest in the Fund, nor shall there be any sale of a security in any jurisdiction where such solicitation or sale would be unlawful.

The Fund’s limited partnership interest will not be registered with the U.S. Securities Exchange Commission or other regulatory authority. Investors will be required to verify their status as an “Accredited Investor” pursuant to Rule 501 of Regulation D to participate in any offering of the Fund’s limited partnership interests. No securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through Collective Liquidity, Inc. or Collective Asset Management, LLC (collectively, “Collective Liquidity”).

Limited partnership interests in the Fund are not insured by the FDIC and are not deposits or other obligations of Collective Liquidity and are not guaranteed by Collective Liquidity. Limited partnership interests in the Fund are subject to investment risks, including possible loss of the principal invested.

Prospective investors should consider the investment objectives, risks, fees and expenses of the Fund carefully before investing in the Fund. This and other important information are contained in the Fund’s Confidential Private Placement Memorandum (“PPM”), which can be obtained by contacting Collective Liquidity.

Investment in the Fund involves substantial risk and any offering may only be made pursuant to the relevant PPM and the relevant subscription application, all of which must be read in their entirety. No offer to purchase securities will be made or accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. The Fund has no history of public trading and investors should not expect to sell limited partnership interests in the Fund. No secondary market exists for the Fund’s limited partnership interests, and none is expected to develop. The Exchange Fund has a limited operating history, and its performance is highly dependent upon the expertise and abilities of its manager. There is no assurance that the Exchange Fund’s investment objectives will be achieved, and results may vary substantially over time. This is not a complete enumeration of the Fund’s risks. Please read the Fund’s PPM for other risk factors related to the Fund. Although the manager of the Exchange Fund will value its portfolio using the Private Market Valuation Algorithm, it can be difficult to obtain financial and other information with respect to private companies, and even where the manager is able to obtain such information, there can be no assurance that it is complete or accurate. Because such valuations are inherently uncertain and may be based on estimates, the manager’s determinations of fair market value may differ materially from the values that would be assessed if a readily available market for these securities existed.

The information contained herein does not constitute a recommendation or advice by Collective Liquidity. You should consult your own tax, legal, accounting, financial or other advisers about the information discussed herein based on your specific risk profile and financial situation, including the suitability of an investment in the Fund, with Collective Liquidity, or any product managed by Collective Liquidity.

The information contained herein is for informational purposes only. This material contains the current opinions of Collective Liquidity and such opinions are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.